Exness Nigeria

Exness is a leading trading platform that provides Nigerian traders access to more than 100 financial instruments, including forex, stocks, cryptocurrencies, and other CFDs. With advanced tools available for both desktop and mobile platforms, Exness ensures an optimal trading experience for traders of all skill levels in Nigeria. The platform is known for its robust security features, fast transactions, and transparent trading conditions.

Deposits and withdrawals are processed quickly, with most withdrawals completed within 24 hours (Depending on selected payment method). Spreads start as low as 0.0 pips, offering competitive trading conditions for Nigerian traders. Exness also offers multilingual support, including English and other widely spoken local languages such as Yoruba and Hausa, ensuring effective communication for users across the country.

Legality of Exness in Nigeria

Exness operates legally in Nigeria and adheres to international standards and regulations to ensure a secure trading environment. It is regulated by several top-tier global authorities, providing Nigerian traders with peace of mind when trading online:

- Financial Services Authority (FSA) – Seychelles

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus

- Financial Conduct Authority (FCA) – United Kingdom

- Financial Sector Conduct Authority (FSCA) – South Africa

- Central Bank of Curaçao and Sint Maarten (CBCS) – Curaçao

- Financial Services Commission (FSC) – British Virgin Islands

- Capital Markets Authority (CMA) – Kenya

In Nigeria, the Central Bank of Nigeria (CBN) regulates foreign exchange and financial markets, while the Securities and Exchange Commission (SEC) monitors and ensures that all financial transactions adhere to national regulations. These institutions create a safe regulatory framework for Nigerian traders to engage with Exness confidently.

Trade Global Markets with Exness Trading Broker

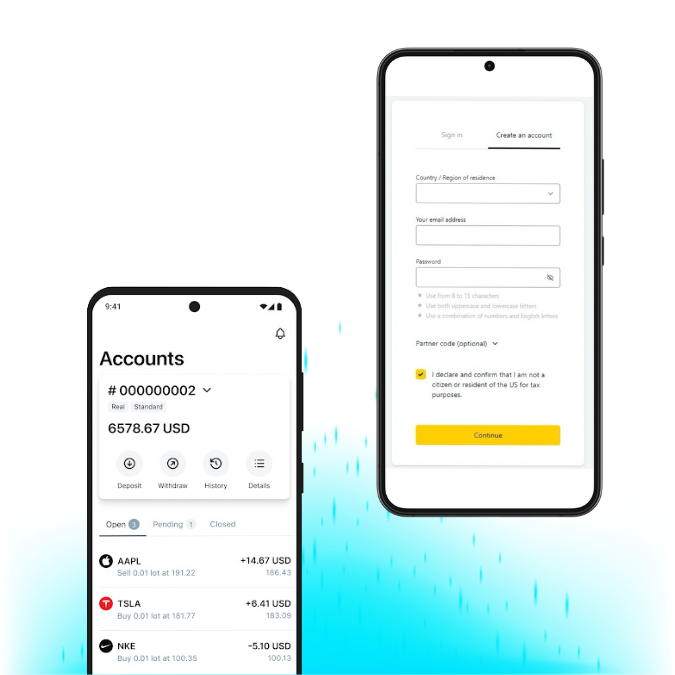

How to Register an Account in Nigeria

Creating an Exness account in Nigeria is a straightforward process. Follow these steps:

- Visit the Exness website or download the Exness app from Google Play or the Apple App Store.

- Click “Sign Up” or “Register” to start the process.

- Enter your name, email address, and phone number.

- Create a secure password and enable two-factor authentication for additional security.

- Complete the identity verification process by uploading the necessary documents.

- Once verified, select the trading account type that best suits your needs.

- Log in and start trading on your new Exness account.

Available Trading Platforms in Nigeria

Exness Content Expert говорить:

Exness Nigeria provides traders in Nigeria with access to industry-leading trading platforms, ensuring flexibility and powerful trading tools:

- MetaTrader 4 (MT4): A globally recognized platform offering advanced charting, technical analysis, and support for automated trading strategies via Expert Advisors (EAs). MT4 is ideal for both new and experienced traders.

- MetaTrader 5 (MT5): The upgraded version of MT4, MT5 provides additional features such as more order types, advanced charting tools, and access to a broader range of financial instruments. MT5 is perfect for traders seeking enhanced trading functionality.

- Exness Mobile App: Designed for traders who need flexibility, the Exness mobile app offers real-time market data, quick trade execution, and full account management. Available on both Android and iOS devices, it ensures that traders in Exness in Nigeria can trade on the go.

Each platform is equipped to handle diverse trading strategies, offering seamless access to global markets. Traders in Exness Nigeria can choose the platform that best aligns with their trading style and goals. For optimal performance, ensure your device meets the platform’s technical requirements and maintain a reliable internet connection.

How to Start Trading Exness in Nigerian

Trading Exness in Nigerian is simple with platforms, offering easy account setup and local payment options. Follow these steps to begin trading quickly and confidently. Here’s how to get started:

- Visit the Exness Nigeria website or download their app from Google Play or Apple App Store.

- Click “Open an Account” and fill in your details like name, email, and phone number.

- Set a secure password and enable two-factor authentication.

- Upload ID documents to verify your account.

- Choose an account type that fits your trading goals.

- Deposit funds using local methods like Paga or bank transfer.

- Log in and start trading.

Once your account is ready, you can trade global markets with ease. Explore tools like MetaTrader 4 or 5 to make informed decisions. Exness’s support team is available to help you succeed.

Account Types for Nigerian Traders

Exness offers various account types for Nigerian traders, tailored to different skill levels and strategies. Each account provides access to global markets with low fees and flexible trading conditions. Below is a table of available account types:

| Account Type | Minimum Deposit | Spread | Leverage | Best For |

|---|---|---|---|---|

| Standard | $10 | From 0.3 pips | Up to 1:2000 | Beginners |

| Pro | $200 | From 0.1 pips | Up to 1:2000 | Experienced traders |

| Zero | $200 | From 0 pips | Up to 1:2000 | High-volume traders |

| Raw Spread | $200 | From 0 pips | Up to 1:2000 | Scalpers and day traders |

These accounts suit traders from novices to professionals. You can test strategies on a demo account before going live. Exness Nigeria ensures fast execution and transparent pricing for all accounts.

Payment Methods for Nigerian Traders

Exness offers several convenient payment options for deposits and withdrawals in Nigeria. Here are some of the most popular methods:

- Local Bank Transfers: Supports major Nigerian banks for direct deposits and withdrawals. Withdrawal times typically range from 1-3 business days.

- E-Wallets: Includes Skrill, Neteller, and WebMoney, with both deposits and withdrawals processed instantly.

- Credit/Debit Cards: Visa and MasterCard are supported, with instant deposits and withdrawals processed in 3-5 business days.

| Payment Method | Minimum Deposit | Processing Time | Supported Currencies | Fees |

| Local Bank Transfers | $10 | 1-3 days | NGN (Nigerian Naira) | No fees from Exness |

| E-Wallets | $10 | Instant | NGN, USD, EUR | No fees from Exness |

| Credit/Debit Cards | $10 | Instant for deposits, 3-5 days for withdrawals | NGN, USD, EUR | No fees from Exness |

Local Payment Methods Exness in Nigeria

Exness offers tailored local payment methods for Nigeria traders, ensuring seamless and efficient transactions. These options are widely used in Nigeria, providing convenience and accessibility for managing trading funds. The available local payment methods are:

- Paystack: A widely used payment gateway for fast and secure local bank transfers.

- Flutterwave: Another popular local payment platform that offers seamless transactions for traders.

These local payment methods enable quick deposits and withdrawals, enhancing the trading experience for Exness Nigeria users. Ensure your account is verified to facilitate smooth transactions. For any issues, Exness’s customer support is available to provide assistance with these payment options.

Minimum Deposit for Nigerian Traders

The minimum deposit to start trading with Exness in Nigeria is as low as $10, making it accessible for beginner traders who want to explore the forex market with minimal initial investment. This low entry barrier allows new traders to start their trading journey without the need for significant capital. For more advanced accounts like Pro, Zero, or Raw Spread, the minimum deposit requirement starts at $200, catering to experienced traders who need more advanced features and tighter spreads. Exness provides flexibility with account types to suit various trading strategies and risk appetites.

Availability of Local Language Support

Exness offers full support in English for Nigerian traders, ensuring easy communication and navigation of the platform. In addition, Exness recognizes the diverse linguistic landscape of Nigeria and provides support in regional languages such as Yoruba, Hausa, and Igbo. This multilingual support helps traders feel more comfortable while using the platform, making it easier to access information, ask questions, and resolve issues in a language they understand. Whether you’re a beginner or an experienced trader, Exness ensures a user-friendly and localized experience for Nigerian traders.

Why Choose Exness in Nigeria?

Exness is a top choice for Nigerian traders due to its easy-to-use platforms and affordable trading options. It supports local payment methods like Paga and bank transfers, ensuring quick and convenient transactions. With dependable customer support and flexible account types, Exness meets the needs of both new and experienced traders, providing a seamless trading experience.

- Low Spreads: Enjoy competitive spreads starting from 0.0 pips, with no hidden fees.

- Fast Executions and Withdrawals: Experience quick trade executions and instant withdrawals, with most withdrawals processed within 24 hours (Depending on selected payment method).

- Local Language Support: Access full support in English and other regional languages like Yoruba, Hausa, and Igbo for better communication.

- Mobile Trading: Stay connected to the market anytime, anywhere with the Exness mobile app.

- Secure Trading Environment: Trade confidently on a platform regulated by top-tier global financial authorities.

With competitive trading conditions, local payment options, and reliable customer support, Exness offers a secure and efficient trading experience for Nigerian traders.

Support for Traders Exness in Nigeria

Exness offers exceptional support for Nigerian traders, ensuring they have everything they need to succeed in the forex market. Their customer service is available 24/7 through live chat, email, and phone, providing quick and helpful responses for local traders. Traders also have access to a wide range of educational resources, including webinars, tutorials, and market analysis, to help them improve their trading skills. With local payment methods like Paga and bank transfers, deposits and withdrawals are fast and secure, while trading platforms like MetaTrader 4 and 5 offer advanced features for a comprehensive trading experience.

Exness resolves any issues promptly, whether it’s account setup or technical problems. For beginners, the platform offers a demo account to practice trading risk-free, helping to build confidence. With fast execution, low spreads, and dedicated support, Exness ensures a reliable and efficient trading environment for Nigerian traders.

Launch Your Trading with Exness Nigeria!

Start your trading journey with Exness, the trusted platform for Nigerian traders. Enjoy easy account registration, access to various trading platforms like MT4, MT5, and the Exness Mobile App, along with convenient local payment methods like Paga and bank transfers. Sign up today to access global markets with fast deposits, secure transactions, and dedicated support—take control of your financial future with Exness!

FAQ

Can I use Exness in Nigeria?

Yes, Exness Nigeria is available for Nigerian traders. You can open an account, deposit funds, and trade in global markets through their platform.

Does Exness have offices in Nigeria?

Currently, Exness Nigeria does not have physical offices in Nigeria. However, you can access the platform online and receive customer support through live chat, email, and phone.

What is the minimum deposit on Exness in Nigeria?

The minimum deposit for Exness Nigeria is $10 for a Standard account, making it accessible for beginners. For other account types, like Pro or Raw Spread, the minimum deposit is typically $200.

Which broker is best in Nigeria?

Exness Nigeria is considered one of the best brokers in Nigeria due to its low spreads, a wide range of account types, excellent customer support, and advanced trading platforms like MT4 and MT5.

Can I withdraw from Exness to my Nigerian bank account?

Yes, you can withdraw funds from Exness Nigeria to your Nigerian bank account through local payment methods such as bank transfers. Processing times may vary depending on the method used.

What countries are banned from Exness?

Exness Nigeria operates in many countries, but there are restrictions on some countries due to local regulations, such as the United States and Japan. You can always check the list of restricted countries on the Exness website.

Why can’t I withdraw from Exness?

If you are unable to withdraw from Exness Nigeria, it could be due to incomplete verification, incorrect payment details, or exceeding withdrawal limits. It’s best to check your account settings or contact Exness customer support for assistance.