Exness Senegal

Foreign exchange and contract-for-difference trading have been growing in popularity across West Africa. In Senegal, access to global financial markets is possible through Exness Senegal, a regulated broker with strong international standing. Traders in the region often evaluate the broker’s legal status, registration process, trading software, and deposit options before creating an account. This article outlines these key aspects, offering practical information for anyone interested in starting with Exness SN.

Legality of Exness in Senegal

Online brokerage services in Senegal operate under international financial regulations, as the country does not have a dedicated authority for retail forex. Exness Senegal works under licenses issued by respected global regulators, such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These frameworks ensure transparency, client fund segregation, and fair execution practices.

Senegalese traders can legally open accounts with Exness Senegal, provided that they comply with the broker’s verification requirements. The platform accepts clients from West Africa without restrictions, allowing users to trade currencies, commodities, indices, and digital assets within a regulated structure.

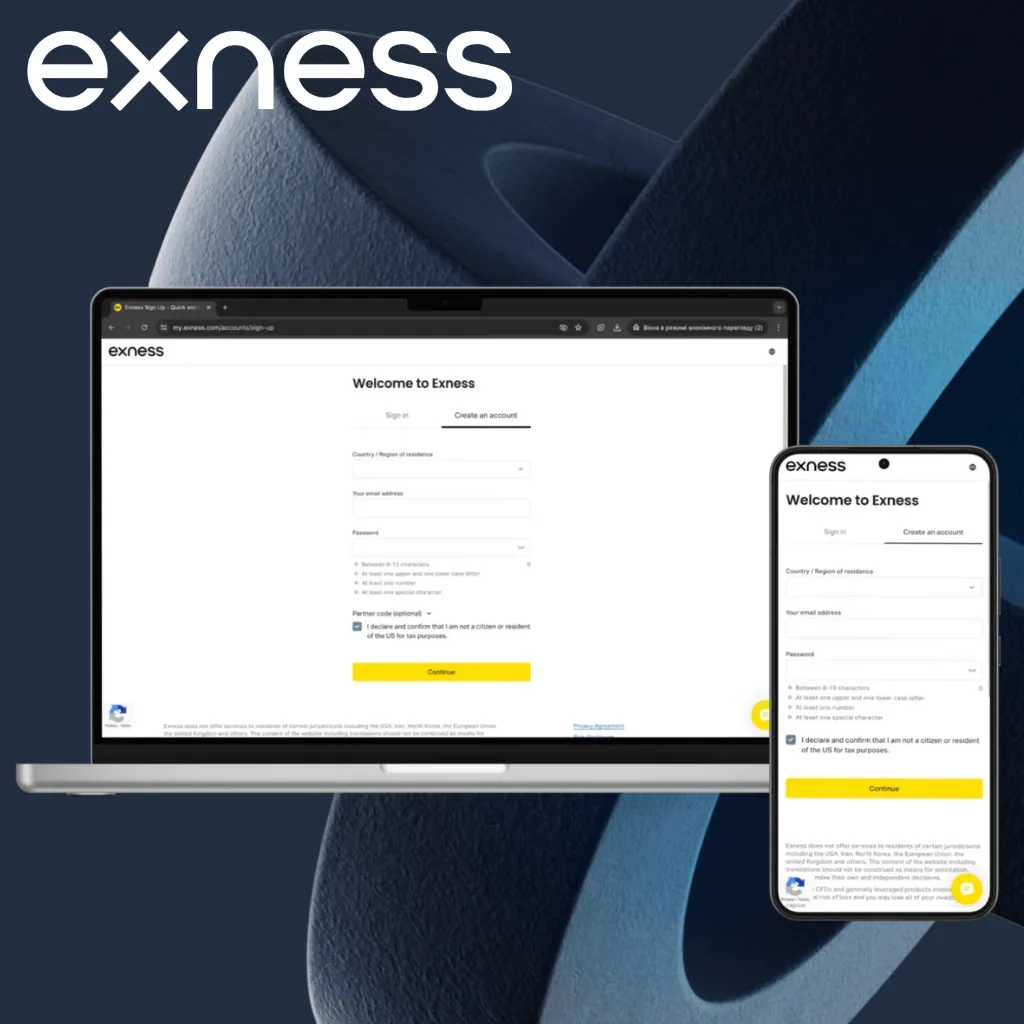

How to Register an Account in Senegal

Opening an account with Exness Senegal is a digital process that takes only a few minutes. Registration requires basic identification and can be completed directly on the website or through the mobile app.

Steps for Account Creation:

- Visit the official website and choose “Create Account.”

- Select Senegal as the country of residence.

- Enter an email address and create a secure password.

- Confirm identity with personal information and ID verification.

- Set up the preferred trading account type (Standard or Professional).

Once registration is complete, users can fund their accounts and begin trading instantly. Verification is mandatory to comply with international financial standards, ensuring a secure trading environment.

Trading Platforms Available in Senegal

The broker offers advanced platforms that are compatible with both desktop and mobile devices. Exness Senegal provides access to the industry-standard MetaTrader terminals, as well as proprietary applications for mobile users.

Available Platforms:

- MetaTrader 4 (MT4) – Popular among forex traders for its stability and fast order execution.

- MetaTrader 5 (MT5) – Offers more advanced features, multiple chart timeframes, and wider asset classes.

- Exness Trade App – A mobile solution that allows account management, deposits, and order execution on the go.

Application Download Guide (Senegal):

- Android users: Download from Google Play by searching “Exness Trade App.”

- iOS users: Available on the App Store with full compatibility for iPhone and iPad.

- Desktop terminals: MT4 and MT5 can be downloaded from the official website, with installation files for Windows and macOS.

Trade Global Markets with Exness Trading Broker

International and Regional Payment Methods in Senegal

One of the strengths of Exness Senegal is its flexible transaction system, which combines global and regional funding channels. The broker ensures fast deposits and withdrawals without hidden charges.

Accepted Methods:

- Bank Cards – Visa and Mastercard transactions are processed instantly.

- E-Wallets – Skrill, Neteller, and Perfect Money are commonly used by West African traders.

- Mobile Payments – Local services such as Orange Money and Wave are available in Senegal, giving traders easy access through widely used telecom-based systems.

- Bank Transfers – Supported by regional banks, though processing can take longer compared to electronic methods.

Minimum Deposit in Senegal

The minimum deposit requirement for Exness Senegal depends on the type of account chosen. Standard accounts are designed to be accessible, while professional accounts require higher capital.

- Standard Account: As low as $1

- Professional Accounts: From $200 to $500, depending on the subtype (Raw Spread, Zero, Pro)

Such flexible deposit requirements make Exness Senegal appealing to both entry-level users and experienced traders with larger strategies.

Availability of Regional Language

Language accessibility plays a critical role in client communication. Exness Senegal is fully available in French, the country’s official language. The platform interface, customer service, and educational materials can all be accessed in French.

In addition, English and other major languages are also available, ensuring that traders with bilingual or international backgrounds can use the platform without barriers. This localized service demonstrates commitment to accessibility in Senegal’s market.

Why Choose Exness in Senegal?

Several factors distinguish Exness SN as a strong choice for Senegalese traders. The broker operates under globally recognized licenses, offers easy digital registration, and supports advanced trading platforms. Localized payment channels such as Orange Money make transactions simple, while a minimum deposit of just $1 ensures broad access.

Key Advantages:

- Fully regulated under international authorities.

- Easy account setup with identity verification.

- Availability of MT4, MT5, and mobile applications.

- Regional payment solutions including Orange Money and Wave.

- Flexible deposit requirements starting from $1.

- French-language availability for local traders.

For these reasons, Exness Senegal stands out as a reliable and efficient option for accessing global markets from West Africa.