Exness Uganda

Exness is a globally recognized trading platform, offering Ugandan traders access to a variety of financial markets, including forex, commodities, stocks, indices, and cryptocurrencies through CFDs (Contracts for Difference). Whether you’re new to trading or a seasoned expert, Exness provides an intuitive and secure trading environment. With real-time market data and advanced trading tools, traders in Uganda can access the platform on both desktop and mobile devices, ensuring flexibility and convenience.

Ugandan traders value Exness for its favorable trading conditions, such as ultra-tight spreads starting from 0.0 pips and fast trade execution with minimal slippage. The platform ensures smooth transactions with fast deposits and withdrawals, most of which are processed within 24 hours (Depending on selected payment method). Exness offers full support in English, making it easy for Ugandan traders to navigate the platform, explore educational resources, and receive customer support in their preferred language.

Legal Status of Exness in Uganda

Exness operates under strict international financial regulations, providing Ugandan traders with a secure and transparent trading environment. The platform is regulated by several renowned global financial authorities, ensuring compliance and transparency:

- Financial Services Authority (FSA) – Seychelles

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus

- Financial Conduct Authority (FCA) – United Kingdom

- Financial Sector Conduct Authority (FSCA) – South Africa

- Central Bank of Curaçao and Sint Maarten (CBCS) – Curaçao

- Financial Services Commission (FSC) – British Virgin Islands

- Capital Markets Authority (CMA) – Kenya

While Uganda does not have a specific local regulator for forex trading, the Bank of Uganda oversees financial services and ensures compliance with financial regulations within the country. Exness adheres to international standards set by its global regulators, providing Ugandan traders with confidence in the platform’s security and transparency.

Trade Global Markets with Exness Trading Broker

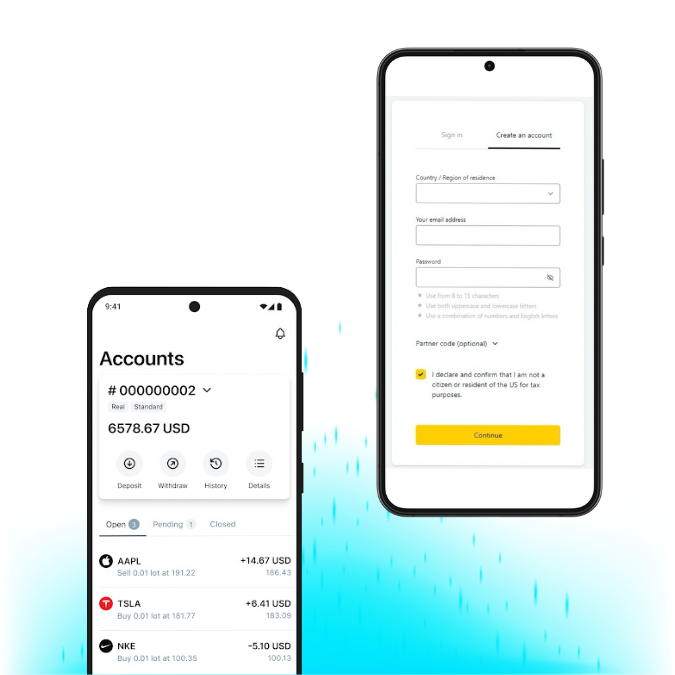

How to Open an Account Exness in Uganda

Opening an Exness account in Uganda is easy and designed to be user-friendly for all traders:

- Access the Exness Uganda website or download the Exness app from the Google Play Store or Apple App Store.

- Enter your personal information, such as name, email, and phone number, to start the registration process.

- Create a strong password and enable two-factor authentication (2FA) for added security.

- Upload your government-issued ID and proof of address to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

- Select from account types like Standard, Pro, Zero, or Raw Spread, each offering different benefits such as lower spreads or faster execution speeds.

- After verification, deposit funds into your account and begin trading in forex, indices, and cryptocurrencies.

Trading Platforms for Ugandan Traders

Exness provides Ugandan traders with multiple industry-leading platforms to enhance their trading experience:

- MetaTrader 4 (MT4): A widely used platform featuring advanced charting tools, technical indicators, and the ability to automate trades through Expert Advisors (EAs).

- MetaTrader 5 (MT5): An upgraded version of MT4, offering more features such as additional timeframes, order types, and access to more asset classes.

- Exness Mobile App: Available on both Android and iOS, the Exness mobile app allows traders to manage accounts, access real-time market data, and execute trades on the go.

Each platform is equipped to handle diverse trading strategies, offering seamless access to global markets. Traders in Exness Uganda can choose the platform that best aligns with their trading style and goals. For optimal performance, ensure your device meets the platform’s technical requirements and maintain a reliable internet connection.

How to Start Trading Exness in Uganda

Trading Exness in Uganda is simple with platforms, offering easy account setup and local payment options. Follow these steps to begin trading quickly and confidently. Here’s how to get started:

- Visit the Exness Uganda website or download their app from Google Play or the Apple App Store.

- Click “Open an Account” and fill in your details such as name, email, and phone number.

- Set a secure password and enable two-factor authentication.

- Upload ID documents to verify your account.

- Choose an account type that aligns with your trading goals.

- Deposit funds using local methods such as bank transfer or mobile money options.

- Log in and start trading.

Once your account is ready, you can trade global markets with ease. Explore tools like MetaTrader 4 or 5 to make informed decisions. Exness’s support team is available to help you succeed.

Account Types for Ugandan Traders

Exness offers various account types for Ugandan traders, tailored to different skill levels and strategies. Each account provides access to global markets with low fees and flexible trading conditions. Below is a table of available account types:

| Account Type | Minimum Deposit | Spread | Leverage | Best For |

|---|---|---|---|---|

| Standard | $10 | From 0.3 pips | Up to 1:2000 | Beginners |

| Pro | $200 | From 0.1 pips | Up to 1:2000 | Experienced traders |

| Zero | $200 | From 0 pips | Up to 1:2000 | High-volume traders |

| Raw Spread | $200 | From 0 pips | Up to 1:2000 | Scalpers and day traders |

These accounts suit traders from novices to professionals. You can test strategies on a demo account before going live. Exness Uganda ensures fast execution and transparent pricing for all accounts.

Payment Methods for Ugandan Traders

Exness offers a variety of fast and secure payment methods for traders in Uganda:

- MTN Mobile Money: A widely used mobile payment service in Uganda that allows for quick deposits and withdrawals.

- Local Bank Transfers: Exness supports local bank transfers for secure and efficient fund management.

- E-Wallets: Popular e-wallets like Skrill, Neteller, and WebMoney offer instant deposits and withdrawals.

- Credit/Debit Cards: Visa and MasterCard are accepted for both deposits and withdrawals.

| Payment Method | Minimum Deposit | Processing Time | Supported Currencies | Fees |

| MTN Mobile Money | $10 | Instant | UGX, USD, EUR | No fees from Exness |

| Local Bank Transfers | $10 | 1-3 business days | UGX, USD, EUR | No fees from Exness |

| E-Wallets | $10 | Instant | UGX, USD, EUR | No fees from Exness |

| Credit/Debit Cards | $10 | Instant for deposits, 3-5 business days for withdrawals | UGX, USD, EUR | No fees from Exness |

Local Payment Methods in Uganda

Exness understands the importance of offering payment options that suit the preferences of Ugandan traders. To ensure smooth and convenient transactions, Exness supports a range of local payment solutions that are both secure and easy to use. Below are the local payment methods available for Ugandan traders:

- MTN Mobile Money: A trusted mobile payment service, MTN Mobile Money offers fast and secure transactions for Ugandan traders.

- Additional Mobile Payment Options: Exness also supports other local mobile payment methods for enhanced convenience.

These local payment methods ensure that Ugandan traders can easily manage their funds, making their trading experience more efficient and accessible.

Minimum Deposit for Ugandan Traders

Exness makes trading accessible for Ugandan traders by offering a low minimum deposit of $10. This allows new traders to start trading without a large upfront investment. For more advanced accounts, such as Pro, Zero, or Raw Spread, the minimum deposit is $200, offering professional traders more competitive trading conditions.

Full English Language Support

Exness offers full support in English, ensuring that Ugandan traders can easily navigate the platform, access educational resources, and receive customer service without any language barriers. 24/7 customer support is available to assist with any issues, from technical questions to account management.

Why Choose Exness in Uganda?

Exness is a top choice for Uganda traders due to its user-friendly platforms and affordable trading options. It supports local payment methods like MTN Mobile Money, making transactions fast and convenient. With reliable customer support and flexible account types, Exness caters to both new and experienced traders, ensuring a smooth and efficient trading experience for all.

- Ultra-Low Spreads: Traders benefit from competitive spreads starting as low as 0.0 pips.

- Fast Withdrawals: Most withdrawals are processed within 24 hours (Depending on selected payment method).

- Flexible Mobile Trading: The Exness mobile app enables traders to stay connected to the markets at any time.

- Local Payment Options: MTN Mobile Money and other local payment methods make managing funds simple and secure.

- Regulated and Transparent: Exness operates under multiple international regulators, ensuring a safe and transparent trading environment.

With its competitive trading conditions, fast withdrawals, and full English language support, Exness provides Ugandan traders with an accessible and secure platform to participate in global financial markets. The platform’s flexibility and low fees make it an ideal choice for traders of all experience levels.

Support for Traders Exness in Uganda

Exness provides excellent support for Ugandan traders, ensuring they have the tools and assistance needed to succeed. Their customer service is available 24/7 via live chat, email, and phone, with responses in English and local languages for convenience. Traders can access educational resources like webinars, tutorials, and market analysis to improve their skills. Local payment methods like MTN Mobile Money and other mobile payment options make deposits and withdrawals quick and secure, while platforms like MetaTrader 4 and 5 offer robust trading features.

For any issues, the support team resolves queries promptly, from account setup to technical problems. Exness also offers a demo account to practice trading risk-free, helping beginners build confidence. With fast execution, low spreads, and dedicated assistance, Exness creates a reliable trading environment for Ugandan traders.

Launch Your Trading with Exness Uganda!

Start your trading journey with Exness, the trusted platform for Ugandan traders. Enjoy seamless account registration, access to a variety of trading platforms like MT4, MT5, and the Exness Mobile App, along with convenient local payment methods like MTN Mobile Money and other mobile payment options. Sign up now to access global markets with fast deposits, secure transactions, and dedicated support—take control of your financial future with Exness!

FAQ

Is Exness available in Uganda?

Yes, Exness is available in Uganda and provides local payment options, secure trading platforms, and dedicated customer support for Ugandan traders.

What is the minimum deposit on Exness in Uganda?

The minimum deposit on Exness in Uganda is $10, allowing traders to start with a low initial investment and access various account types.

How to withdraw money from Exness in Uganda?

To withdraw money from Exness in Uganda, log in to your account, choose a preferred local payment method such as MTN Mobile Money, and follow the instructions to complete the withdrawal.

Which country is Exness from?

Exness is an international broker with its headquarters in Limassol, Cyprus. It is regulated by multiple financial authorities worldwide.

How to verify Exness account in Uganda?

To verify your Exness account in Uganda, you need to upload a valid government-issued ID (passport, national ID, or driver’s license) and a proof of address (e.g., utility bill or bank statement) within your account settings.

Which is the best forex broker in Uganda?

Exness is considered one of the best forex brokers in Uganda due to its user-friendly platforms, reliable customer support, local payment methods, and competitive trading conditions.

How long does it take to withdraw from Exness?

Withdrawals from Exness are processed quickly. Depending on the payment method, it may take anywhere from a few minutes to a few hours for funds to reach your account.

Who owns Exness?

Exness was founded by Petr Valov and Igor Lychagov. It is a private company with no single owner, but it is operated by a team of experienced professionals in the financial and technology sectors.