What Is Algo Trading Software?

Algo trading software uses pre-set instructions to execute trades based on price, volume, or indicators like RSI. It pulls real-time data from exchanges, processes it, and sends orders via APIs. A basic bot might scalp 5 pips on EUR/USD; advanced ones arbitrage price gaps across markets. Expect 100+ trades daily on liquid pairs. Latency under 20ms is key for scalping. Always build in stop-losses to cap risks during news spikes.

Top Algo Trading Software in 2025

These platforms stand out for fast execution, robust testing, and broker compatibility. They support stocks, forex, and crypto, with options for no-code beginners or coders. Each offers backtesting on historical data and live trading with sub-50ms latency. Pick based on your goals: ease for starters, flexibility for pros.

MetaTrader 5

MetaTrader 5 (MT5) runs automated scripts for forex, stocks, and futures, with execution under 20ms via ECN brokers like IC Markets. Its free platform includes a strategy tester for 99% accurate backtests. Traders build bots with built-in tools or buy thousands from its marketplace. Spreads start at 0.0 pips, and VPS support ensures uptime.

Key features:

- 38 indicators for quick setups

- Multi-asset trading on 1000+ symbols

- Community marketplace for pre-built bots

- Free demo with $10k virtual funds

MT5 suits beginners for its templates and pros for its deep customization, especially on forex pairs like GBP/JPY.

Interactive Brokers TWS

Interactive Brokers TWS offers API-driven automation for global markets, hitting sub-10ms execution. It covers 150+ asset types, from options to crypto. No minimum deposit, with fees as low as $0.005 per share. Backtest on decades of tick data; deploy via cloud or local servers. Its risk dashboard flags overexposure.

Notable perks:

- FIX and Web APIs for custom builds

- Multi-market scanner for arbitrage

- Portfolio analytics for drawdowns

- Free paper trading account

TWS is ideal for traders scaling from small accounts to institutional, with tools for complex strategies.

cTrader

cTrader automates trades with no-code bots or custom scripts, hitting 15ms latency on brokers like Pepperstone. It shows level II depth for slippage control, perfect for forex scalping. Free via brokers, it supports 80+ pairs and CFDs. Backtest with tick-level precision.

Standouts:

- Visual bot builder for beginners

- ECN execution with 0.1 pip spreads

- Real-time order book access

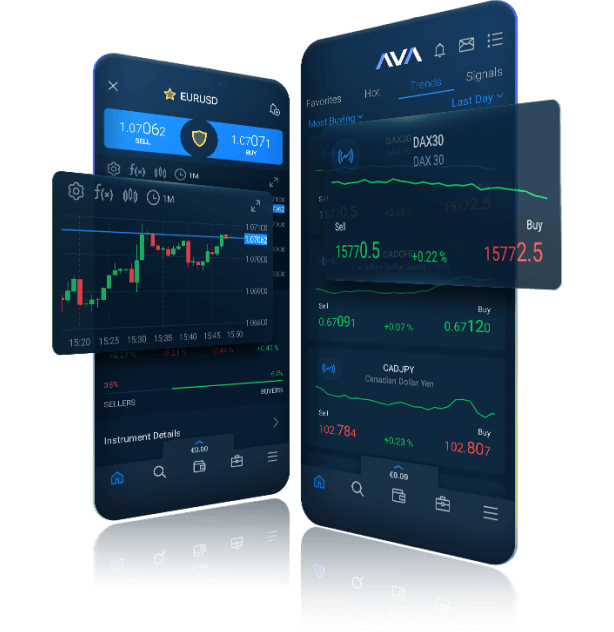

- Mobile app for trade monitoring

cTrader fits active traders who want fast fills and clear market views without heavy coding.

QuantConnect

QuantConnect’s open-source platform tests and deploys algos on cloud, free for basics or $8/month for live trading. It handles stocks, forex, and crypto with petabytes of historical data. Community shares 3000+ strategies for quick starts. Live links to brokers like IBKR.

Advantages:

- Free tick data for backtesting

- Cloud-based for low setup costs

- Multi-asset universe selection

- Active forum for shared code

Best for coders building custom systems before live runs.

NinjaTrader

NinjaTrader automates via scripts for futures and forex, with 30ms latency on CME feeds. Free for sim; live trading at $99/month with brokers like Phillip Futures. Its Market Replay tests strategies on past sessions. Fees start at $0.53/contract for futures.

Key benefits:

- Order flow and volume visuals

- ATM strategies for bracket orders

- Backtest with tick-by-tick data

- Custom indicator builder

NinjaTrader excels for futures traders needing detailed market depth.

TradeStation

TradeStation automates with low-code tools, executing under 50ms. Fees at $0.60/contract for futures; platform $99/month, waived for active accounts. Test 20 years of data with its optimizer. Covers stocks, ETFs, and crypto via direct routes.

Highlights:

- RadarScreen for real-time scans

- Portfolio-level risk tools

- Easy-to-build custom alerts

- Free sim with historical data

It’s great for day traders moving from manual to automated setups.

How to Pick Algo Trading Software

Selecting the right algorithmic trading software is critical for speed, accuracy, and long-term success. Automated systems rely on milliseconds and data quality, so small inefficiencies can make or break results. Always prioritize stability, broker compatibility, and transparent performance reporting when choosing your setup.

Key factors to consider:

- Latency: Choose software with execution speeds under 10ms for stocks and 20ms for forex to ensure minimal slippage.

- API Compatibility: Match the broker’s API type with your coding experience — FIX API for professionals or MT4/MT5 API for beginners.

- Backtesting: Run simulations using at least 6 months of tick data. Look for consistent win rates above 60% in stable and volatile markets.

- VPS Hosting: Allocate around $20/month for a VPS near key data centers such as LD4 (London) or NY4 (New York) to reduce execution delay.

- Trading Costs: Watch commissions closely; aim for under $3 per lot to maintain profitability on frequent trades.

- Broker Regulation: Always link your algo system to a regulated broker to avoid liquidity traps or price manipulation during live trading.

Proper setup ensures your bot reacts instantly to market changes while keeping trading costs under control. A reliable platform minimizes connection drops and maintains consistent execution speed across all market sessions.

Risks of Algo Trading Software

Bugs can trigger endless trades, wiping accounts in hours. Flash crashes, like 2015’s ETF drop, burn margins fast. Over-optimized bots fail in new conditions; test out-of-sample. High volumes raise fees—$5k/month on heavy scalping. Regulators fine spoofing up to $1M. Cap positions at 5% equity and set daily loss limits.

Setting Up Algo Trading Software

Setting up a functional algo trading system requires technical precision and ongoing monitoring. Start by choosing a trusted ECN broker like FXCM, IC Markets, or Pepperstone for low latency and transparent pricing.

Example setup process:

- Install MetaTrader 5 or similar advanced software

- Code a breakout bot with a 1:2 risk-to-reward ratio.

- Rent a VPS in Equinix NY4 for $20/month to target 10ms latency.

- Backtest your strategy using recent market data (e.g., 2024) to confirm at least 65% win accuracy.

- Go live with a $5,000 account, risking 1% per trade for controlled exposure.

- Monitor your bot using activity logs, and adjust parameters monthly based on volatility and market behavior.

Consistent monitoring and optimization keep your algo competitive as markets shift. Automation can improve accuracy and speed, but supervision remains essential for avoiding costly errors and adapting to new trading conditions.

Regulations for Algo Trading in 2025

SEC’s CAT tracks orders in nanoseconds for manipulation checks. MiFID II in EU limits algo speeds on dark pools. ASIC bans retail arbitrage tricks. Pros with $1M+ net worth get fewer restrictions. Brokers log all trades for audits. Verify via FINRA BrokerCheck to stay compliant.

Hardware for Algo Trading Software

High-end GPUs crunch data 10x faster than CPUs for $10k setups. Co-location in Chicago costs $2k/month for 1ms edges. SSDs store 1TB of ticks for a year’s forex data. Minimum 10Gbps bandwidth. Start free on cloud like AWS, scale to dedicated for live trading.

FAQ

What speed is critical for algo trading software?

Under 50ms end-to-end; pros aim for 1ms with co-location. Retail needs 20ms via VPS.