Top Copy Trading Platforms in 2025

Here are some of the most popular and trusted platforms that let you copy professional traders across forex, crypto, and CFD markets. Each platform provides easy account setup, performance stats, and tools to manage your risk and investment size.

Recommended Platforms:

eToro

eToro is one of the most recognized names in copy trading, known for its social trading community with millions of users worldwide. It allows traders to follow and automatically copy professional investors based on performance, risk level, and portfolio type. eToro supports forex, stocks, crypto, and commodities in one account.

eToro App Overview

Platform Highlights:

- Copy thousands of verified traders

- Minimum deposit: $200

- Regulated by FCA, CySEC, and ASIC

- Real-time performance tracking and portfolio sharing

eToro is perfect for beginners who want to start with an easy interface and transparent trader statistics. The platform also offers educational tools and a free demo account for testing strategies.

ZuluTrade

ZuluTrade connects users with professional signal providers across multiple brokers. It ranks traders based on their performance, consistency, and drawdown, helping users pick the right ones. You can adjust trade size, risk parameters, and close trades manually when needed.

ZuluTrade App Overview

Key Features:

- Copy traders from top brokers

- Performance-based trader rankings

- Auto and manual control modes

- Minimum deposit: $100

ZuluTrade works best for users who already have an account with a partnered broker. It’s suitable for both hands-off investors and traders who want flexibility in risk management.

AvaTrade

AvaTrade offers its AvaSocial and DupliTrade platforms for copy trading. Users can link to verified strategy providers and mirror trades automatically. The platform supports forex, indices, and commodities and is fully regulated by ASIC, FSA, and CySEC.

AvaTrade App Overview

Main Advantages:

- User-friendly mobile app

- Free demo account

- Transparent trader performance reports

- Minimum deposit: $100

AvaTrade’s copy trading options are perfect for users seeking regulated brokers with clear profit-sharing structures. Its support for MT4 and MT5 also allows seamless integration with algorithmic systems.

FXTM Invest

FXTM Invest allows clients to copy Strategy Managers through a secure and user-friendly interface. Investors can track live performance, profitability, and trading style. The platform offers low minimum deposits and flexible commission structures for copied trades.

FXTM App Overview

Highlights:

- Minimum deposit: $100

- Customizable profit-sharing options

- Detailed trader performance dashboard

- Regulated by CySEC and FSC

FXTM Invest is excellent for traders looking to diversify across multiple managers and control how much capital is allocated to each strategy.

RoboForex CopyFX

RoboForex’s CopyFX platform offers a clear structure for followers and traders. Users can copy successful strategies or share their own to earn commissions. CopyFX works on MT4 and MT5, allowing traders to analyze and modify copied positions as needed.

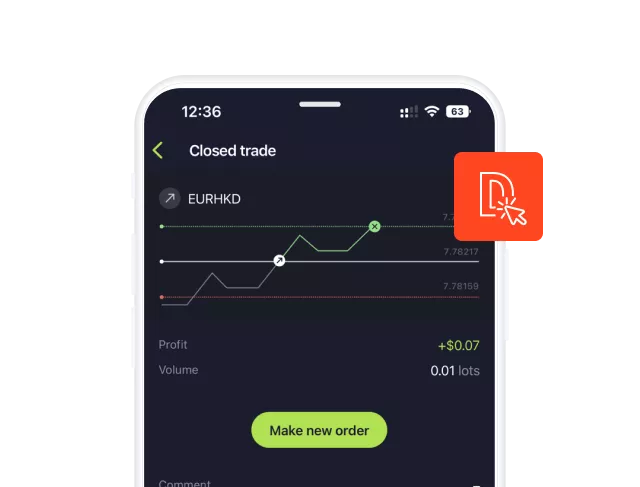

RoboForex App Overview

Features:

- Minimum deposit: $10

- Leverage up to 1:2000

- More than 12,000 instruments

- Available for both followers and providers

RoboForex is ideal for traders who want flexibility between automated and manual strategies, as it combines low entry barriers with strong technical support.

Pepperstone

Pepperstone partners with third-party platforms like Myfxbook AutoTrade and DupliTrade to deliver advanced copy trading services. Users can mirror professional traders’ accounts and access in-depth analytics on each strategy.

Pepperstone App Overview

Core Features:

- ECN execution with 0.0 pip spreads

- Platforms: MT4, MT5, cTrader

- Regulated by ASIC and FCA

- Supports both manual and auto trading

Pepperstone is known for speed and transparency, making it ideal for traders who want to follow professional strategies with minimal delay or slippage.

How Copy Trading Works

Copy trading connects your account to a professional trader’s strategy. Every time they open, modify, or close a trade, the same action happens in your account. You can decide how much capital to allocate and adjust risk settings anytime. Profits and losses mirror the master trader’s performance proportionally to your investment size.

It’s important to monitor copied strategies regularly. Even top traders can have drawdowns, so keeping track of performance metrics like risk score and return consistency helps protect your balance.

Advantages of Copy Trading

- Saves time — no need for constant chart monitoring

- Access to experienced trader strategies

- Suitable for beginners and passive investors

- Transparent performance and risk data

- Diversify across multiple markets and traders

Copy trading can also serve as a learning tool. Watching how successful traders operate helps beginners understand strategy management, entry timing, and risk control.

Risks of Copy Trading

While copy trading simplifies investing, it’s not risk-free. Following unverified or high-risk traders can lead to large losses. Market volatility, strategy changes, or poor money management by the provider may impact your results. Always use risk-limiting settings and diversify across several traders.

Tips for Successful Copy Trading

- Research traders with consistent returns and low drawdowns.

- Avoid copying traders who risk more than 5% per trade.

- Start small, then scale your investment gradually.

- Check trading history — a minimum of 6 months is a good benchmark.

- Withdraw profits regularly and monitor performance weekly.

A disciplined approach ensures that copy trading remains profitable in the long term.

FAQ

Is copy trading profitable?

Yes, if you follow skilled and consistent traders with proven track records. However, results depend on market conditions and risk management.