What Is a Crypto Broker

A crypto broker is a platform or company that allows users to trade cryptocurrencies such as Bitcoin, Ethereum, or Litecoin. Instead of trading directly on an exchange, users can buy and sell through the broker, which gives access to better trading tools, fixed spreads, and customer support.

Top 5 Crypto Brokers

Here are five trusted brokers that offer crypto trading with reliable service, user-friendly platforms, and strong security.

eToro

eToro is one of the best-known crypto brokers, offering both real crypto trading and CFDs. It supports dozens of coins and has a social trading feature where users can copy professional traders.

eToro App Overview

Main Features:

- User-friendly platform and mobile app

- Copy Trading function

- Wallet for crypto storage

- Regulated in several countries

eToro is a good choice for beginners who want to start with small investments and follow experienced traders.

Crypto.com

Crypto.com offers a complete trading platform with spot and derivatives markets. The broker also provides a Visa card for spending crypto and earning cashback.

Crypto.com App Overview

Main Features:

- Large selection of cryptocurrencies

- Secure storage and insurance on funds

- Crypto debit card with rewards

- Mobile app with trading and staking

Crypto.com is great for users who want to trade, spend, and earn crypto rewards all in one place.

Binance

Binance is the largest crypto exchange in the world, but it also operates as a broker. It offers low fees, deep liquidity, and hundreds of coins.

Binance App Overview

Main Features:

- Advanced trading platform with charts

- P2P, spot, and futures trading

- Low trading fees and high liquidity

- Educational content and tools

Binance fits active traders who want strong market access and a variety of trading options in one platform.

AvaTrade

AvaTrade is a regulated forex and CFD broker that also supports crypto trading. It offers fixed spreads and easy-to-use tools for trading coins like Bitcoin, Ethereum, and Ripple.

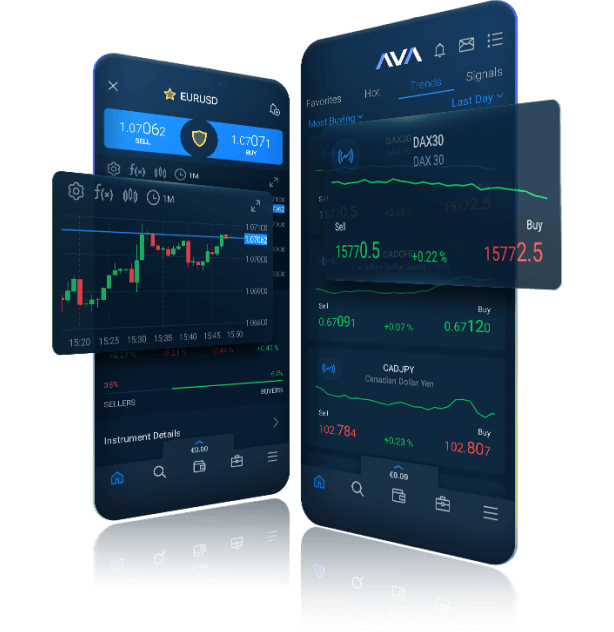

AvaTrade App Overview

Main Features:

- Regulated in multiple jurisdictions

- MT4 and MT5 support

- Fixed spreads on crypto CFDs

- Free demo account

AvaTrade is ideal for traders who prefer CFD trading with clear costs and strong regulation.

XM

XM allows clients to trade crypto CFDs with flexible leverage and tight spreads. It offers a simple interface suitable for both beginners and experienced users.

XM App Overview

Main Features:

- Over 55 crypto pairs available

- Fast order execution

- No hidden commissions

- Educational resources and webinars

XM combines user-friendly trading with professional tools and reliable customer service.

How to Choose the Right Crypto Broker

Choosing the right crypto broker depends on your goals, experience, and trading style. Check the following points before you open an account:

- Regulation and license: Ensure the broker is authorized by financial authorities.

- Security: Look for 2FA, fund insurance, and encrypted transactions.

- Fees: Compare spreads, commissions, and withdrawal costs.

- Platform usability: Make sure it’s easy to trade and monitor your account.

- Support: Reliable customer service is important for quick help.

A secure, transparent broker makes a big difference in your crypto trading success.

Benefits of Trading Crypto with a Broker

Trading with a crypto broker gives access to:

- Regulated platforms with safety measures

- Professional charts and analysis tools

- Leverage options to control bigger positions

- 24/7 trading with mobile support

Brokers simplify crypto trading and help users reduce risks while staying active in the market.

Risks of Crypto Trading

Crypto trading is risky because prices change fast and markets are volatile.

Common risks include:

- Sudden price drops

- Low liquidity for some coins

- Leverage losses

- Security breaches on weak platforms

Always trade with money you can afford to lose and use stop-loss tools to control risks.

Useful Tips for Beginners

Starting your crypto trading can be exciting, but it’s important to build a solid foundation before risking real money. Many new traders lose funds early because they skip the basics or trade based on emotions. The best approach is to practice, learn, and develop discipline over time.

Here are some key tips to help you trade smarter:

- Start with a demo account before using real money. This helps you understand how orders work and how prices move without financial risk.

- Learn how the crypto market works, including trading hours, volatility, and how news affects prices.

- Don’t follow hype or social media tips blindly. Always research coins, projects, and market trends before investing.

- Keep your private keys and passwords safe by using secure wallets and enabling two-factor authentication.

- Track your results and adjust your strategy regularly to identify strengths and weaknesses.

- Manage your emotions — avoid chasing losses or overtrading after small wins.

Consistent learning, proper risk management, and patience are the real keys to long-term success in crypto trading. Focus on building experience gradually, and treat each trade as part of a structured plan rather than a quick way to profit.

Crypto Broker vs Crypto Exchange

A crypto broker and a crypto exchange both allow users to trade digital currencies, but they work in different ways. A broker acts as an intermediary, setting prices and executing trades directly for clients, often with easier interfaces and additional tools. An exchange, on the other hand, connects buyers and sellers directly, offering more control over pricing but requiring greater trading knowledge.

| Feature | Crypto Broker | Crypto Exchange |

|---|---|---|

| Trading Type | CFDs or direct crypto | Direct coin trading |

| Regulation | Often licensed | Depends on region |

| Tools | More professional | Basic or advanced |

| Speed | Usually faster | Depends on liquidity |

| Support | 24/7 customer service | Limited or ticket-based |

Brokers are better for traders who prefer easier setups and regulated services, while exchanges suit users who want to hold actual coins.

Popular Cryptocurrencies to Trade

Cryptocurrency trading has become a key part of online investing, with brokers now offering access to major coins alongside traditional assets. These digital currencies attract traders due to their volatility, liquidity, and potential for both short- and long-term profit opportunities.

Most traded cryptocurrencies on broker platforms include:

- Bitcoin (BTC) – the first and most valuable digital asset, used as the benchmark for the crypto market.

- Ethereum (ETH) – popular for its smart contracts and DeFi applications.

- Litecoin (LTC) – known for faster transactions and lower fees than Bitcoin.

- Ripple (XRP) – focuses on quick and low-cost international payments.

- Cardano (ADA) – recognized for its eco-friendly blockchain and long-term scalability.

These coins are supported by most leading brokers and offer high trading volume, making them suitable for both beginners and professionals. Major brokers provide crypto CFDs, allowing traders to speculate on price movements without owning the coins. Still, crypto markets remain volatile, so managing risk and setting clear stop-loss levels is essential for long-term success.

FAQ

What is a crypto broker?

A crypto broker is a company that lets you trade cryptocurrencies easily through a trading platform or app.