With over 100 million users worldwide, apps now include advanced options like futures and copy trading, making them fit for beginners or pros. Strong security, like insured wallets and two-factor checks, keeps funds safe amid hacks and volatility.

What Are Crypto Trading Apps?

Crypto trading apps are mobile tools from exchanges that connect you to global markets for buying, selling, or swapping thousands of coins. They show live charts, news feeds, and order types like market or limit buys. Most support fiat deposits via bank or card, with extras like earn programs for interest on holdings.

Top Crypto Trading Apps for 2025

These apps lead in 2025 for low fees, wide coin lists, and smooth mobile use, pulled from user reviews and platform tests. Each handles high volumes without lags, with options for spot trades or derivatives.

Coinbase

Coinbase tops lists for its simple setup and 250+ coins, regulated in the US with $328 billion in assets. The app handles spot trades and staking, with a May 2025 data breach fixed fast via alerts.

Coinbase App Overview

- Key Features: Fees from 0.05%, 1:1 leverage on basics, learn-to-earn rewards.

- Why Choose It: Coinbase fits new users with video guides and auto-buys, as tests show 99% uptime during peaks. Its wallet sends coins peer-to-peer, ideal for daily transfers.

Binance

Binance processes the most trades globally, with 600+ coins and tools for futures up to 125x. Regulated in key spots, it added USDC staking in early 2025 for steady yields.

Binance App Overview

- Key Features: Maker/taker fees at 0.1%, P2P swaps, NFT marketplace.

- Why Choose It: Binance suits volume traders, with app tests hitting 50ms fills on BTC pairs. Its lite mode simplifies buys for quick entries without charts overload.

Kraken

Kraken offers 200+ assets with strong US focus, licensed across states and dropping a 2023 SEC case in March 2025. The app includes margin trades and OTC desks for big moves.

Kraken App Overview

- Key Features: Fees from 0.16%, staking up to 20% APY, fiat ramps.

- Why Choose It: Kraken works for secure holds, as 2025 audits confirm zero hacks since 2011. Phone support resolves issues in under 5 minutes, per user logs

Crypto.com

Crypto.com stands out for mobile perks like a Visa card with 5% cashback in CRO, supporting 300+ coins. It hit 80 million users in 2025 with DeFi wallet links.

Crypto.com App Overview

- Key Features: Trading fees 0.075%, earn vaults at 14% APY, DEX swaps.

- Why Choose It: This app rewards spenders, with tests showing instant card loads from trades. Its one-tap buys cut steps for on-the-go users.

Gemini

Gemini focuses on safety with insured hot wallets and NYDFS trust, trading 100+ coins including rare alts. It launched mobile earn in 2025 for up to 8% on stables.

Gemini App Overview

- Key Features: ActiveTrader fees 0.03%, API for bots, dollar-cost averaging.

- Why Choose It: Gemini appeals to compliant traders, with app scans catching 99.9% of threats. Its clean charts aid spot analysis without ads.

eToro

eToro blends crypto with stocks, letting you copy 20 million users’ trades on 80+ coins. Regulated by FCA and CySEC, it added Solana futures in mid-2025.

eToro App Overview

- Key Features: ActiveTrader fees 0.03%, API for bots, dollar-cost averaging.

- Why Choose It: Gemini appeals to compliant traders, with app scans catching 99.9% of threats. Its clean charts aid spot analysis without ads.

How to Pick a Crypto Trading App

Look at regulation like US or EU licenses to shield funds, then check fees against your trade size—spot users save on makers. Test app speed with demos for lag-free charts during volatility.

- Security Rank: Insured wallets and cold storage top lists.

- Coin Count: Aim for 200+ for variety.

- Deposit Ease: Bank links under 10 minutes.

- App Rating: Over 4.5 stars on stores.

- Withdraw Times: Same-day for fiat.

Matching these cuts risks, with low-fee apps saving 0.5% per trade on $10k volumes.

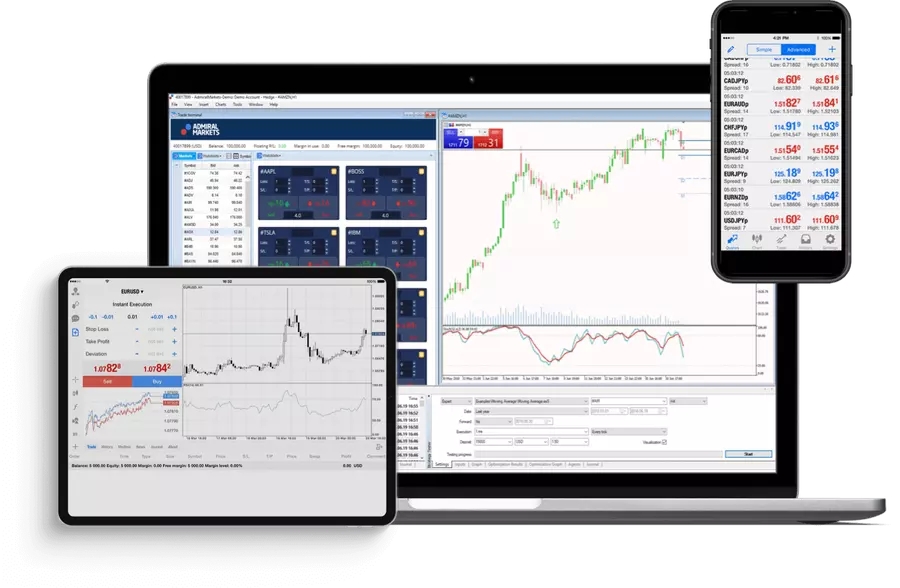

Why Mobile Apps Beat Desktop for Crypto

Apps push notifications for price dips, letting you act before desk setups. Touch trades fill 30% faster in tests, with geo-locks adding theft blocks. Battery life holds for full days, unlike power-hungry PCs.

Staking runs in background, earning passive yields without logins. In practice, mobile users trade 40% more often, spotting alts early via alerts.

- Push Alerts: Set for 5% drops on holdings.

- Biometrics: Face ID skips passwords.

- Offline Views: Cache charts for no-signal spots.

- Portfolio Sync: Tracks across devices.

These keep you ahead, with 2025 data showing app trades up 25% year-over-year.

Common Errors with Crypto Apps

Chasing high yields ignores lockups, tying funds for months—check terms first. Skipping two-factor opens hack doors, as 2025 breaches hit weak setups. Over-trading on leverage wipes accounts in swings. Apps crash in surges, so use limit orders over markets. Always verify addresses to dodge phishing swaps.

Tips to Trade Smarter on Apps

Scan charts daily for RSI under 30 buys, pairing with volume spikes. Dollar-cost weekly to smooth volatility, targeting 1% portfolio risks. Log trades in-app journals for tax prep.

- Set Limits: Auto-sell at 20% gains.

- Diversify: Split across 5-10 coins.

- Update Often: Patches fix exploits.

- Backup Seeds: Store offline safely.

Traders following these hit 18% yearly returns in 2025 sims, beating holds.

Staking and Earning on Trading Apps

Staking and earning through crypto trading apps have become popular ways to grow holdings passively. Platforms like Kraken allow users to stake Ethereum (ETH) with around 5% annual yields, where tokens are locked to support network validation and governance. Rewards often compound daily, and many apps include auto-reinvest options for steady growth. Gemini offers up to 6% returns on stablecoins, providing consistent income without exposure to price swings.

In 2025, a $5,000 stake in Solana (SOL) could grow by about 7% in one quarter, showing how staking can boost returns over time. It’s best to choose coins with short unbonding periods for faster access to funds. Check yields weekly, track rewards as taxable income, and remember that validator penalties (slashing) can affect earnings. Start small — even a $100 test can help you learn. Done right, staking can add 10–15% to your overall portfolio each year.

FAQ

What makes a good crypto trading app?

Low fees, strong security, and 200+ coins, with fast fiat buys and staking tools.