Top Forex Brokers for 2025

Below is a list of trusted forex brokers that are suitable for both beginners and professional traders. Each of them is regulated, offers strong platforms, and has competitive spreads.

XM

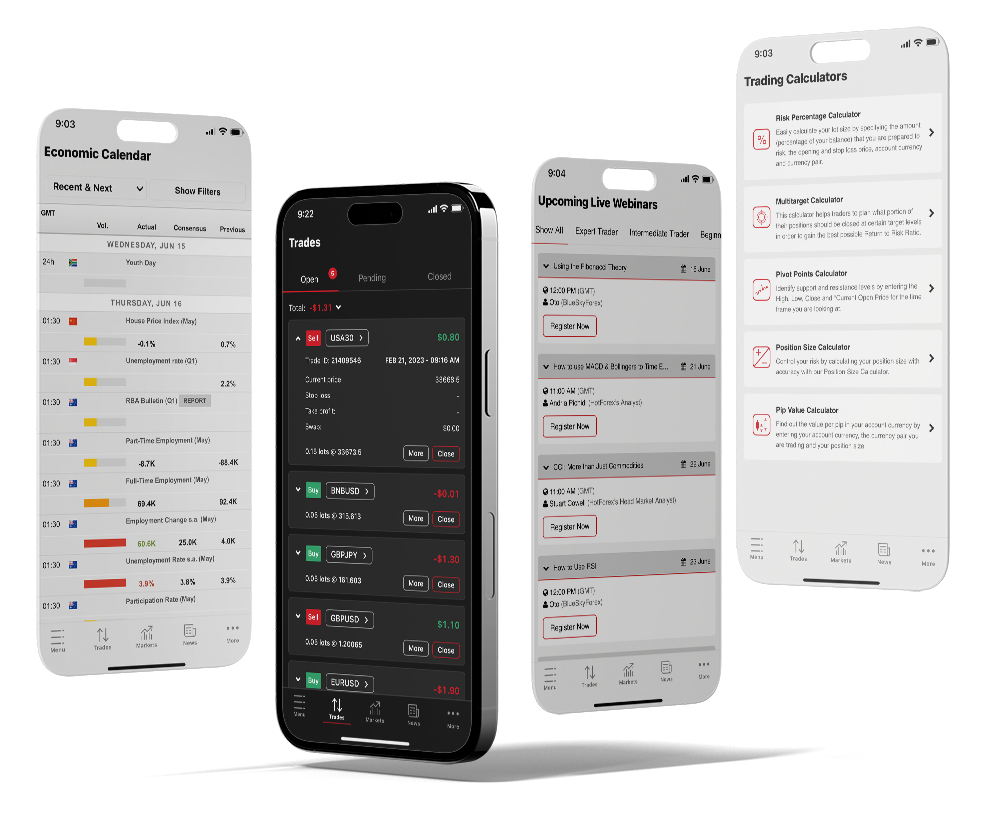

XM App Overview

Regulation: CySEC, ASIC

Platforms: MT4, MT5

Minimum Deposit: $5

Spreads: From 0.6 pips

XM is ideal for traders who prefer low deposits and reliable execution. It offers various account types, flexible bonuses, and quality educational tools. XM also supports mobile trading and multilingual customer service, making it easy to access markets worldwide.

IC Markets

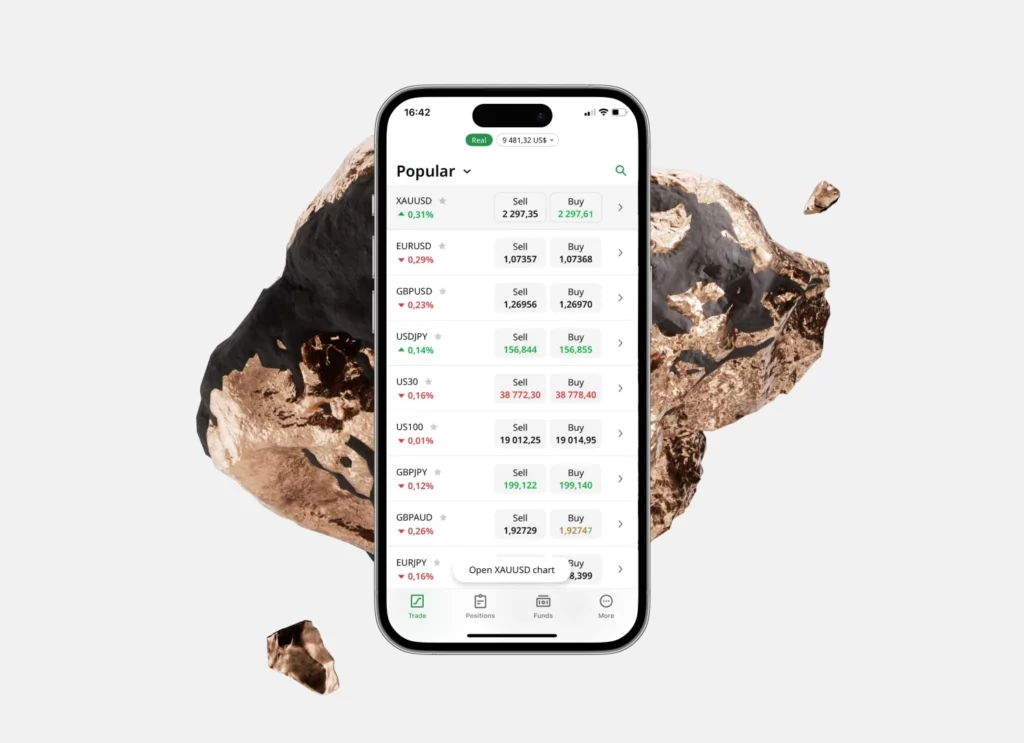

IC Markets App Overview

Regulation: ASIC, CySEC

Platforms: MT4, MT5, cTrader

Minimum Deposit: $200

Spreads: From 0.0 pips

IC Markets is a popular broker for professional traders and scalpers. It offers raw spreads, quick execution, and stable liquidity. With direct market access and strong analytics, it suits those who trade actively during major sessions.

Pepperstone

Pepperstone App Overview

Regulation: FCA, ASIC

Platforms: MT4, MT5, cTrader

Minimum Deposit: $0

Spreads: From 0.0 pips

Pepperstone offers tight spreads and high execution speed. It’s known for supporting algorithmic and automated trading through cTrader and MetaTrader. Traders benefit from 24/5 support and educational tools for improving strategies.

AvaTrade

AvaTrade App Overview

Regulation: Central Bank of Ireland, ASIC, FSCA

Platforms: MT4, MT5, AvaTradeGo

Minimum Deposit: $100

Spreads: From 0.9 pips

AvaTrade provides safe and flexible trading across multiple markets, including forex, stocks, and crypto. Its mobile app is well-designed for beginners and experienced traders. AvaTrade also offers fixed spreads and advanced risk management tools.

FXTM

FXTM App Overview

Regulation: FCA, CySEC

Platforms: MT4, MT5

Minimum Deposit: $10

Spreads: From 1.0 pips

FXTM is a trusted choice for traders looking for a balance between cost and performance. It provides access to educational content, analytics, and low-cost trading accounts. Fast deposits and withdrawals make it convenient for active users.

How to Start Trading Forex

Before opening a real account, spend time on a demo account. This helps you practice with virtual money, learn how trades work, and test your strategies safely. Once you are confident, you can move to a real account with a small deposit.

Choose a broker that offers low spreads and good order execution. Make sure your broker is regulated and uses secure payment methods. Beginners should also take advantage of webinars, market analysis, and trading signals to make informed decisions.

Choosing the Right Account Type

The selection of a proper account type can affect your trading experience and result to a great extent. Most brokers offer various options according to your expense and aims of trading.

Some usual account types include:

- Standard Account: The best option for beginners. It is associated with an average deposit amount and fixed or variable spreads.

- Micro Account: Best for minor traders. You can trade from as little as $5–$10, so it is perfect for learning risk control.

- ECN Account: Suitable for serious traders who want direct market access, extremely tight spreads, and quicker execution.

When making your choice, check for margin requirements, commission charges, and leverage limits. If new, start with a micro or standard account to limit risk and gain experience. Over time, as your experience grows, you may upgrade to an ECN account for better pricing and speed in execution.

Trading Tools and Strategies That Work

Successful forex trading is based on the use of correct tools and a consistent strategy. Most stable brokers have built-in features like technical indicators, economic calendars, and live news feeds. They enable you to analyze market trends and make decisions based on facts.

The following are some useful tools and techniques:

- Moving Averages: Establish the general direction of the market (trend).

- Support and Resistance Levels: Plot significant price zones for potential entries or exits.

- Price Action Analysis: Interpret candlestick patterns to measure momentum.

- Copy Trading: Automatically follow veteran traders to learn from their strategies.

Always strategize your trades prior to entering the market. Implement stop-loss and take-profit orders to manage risk. Never trade emotionally — fear and greed are the most common reasons traders lose money. Backtest your strategy under various market conditions and follow a consistent routine.

Discipline and patience are your most powerful tools. Monitor your performance on a weekly basis, note mistakes, and tweak your method continuously. Eventually, the combination of technical analysis, good risk management, and discipline will turn you into a confident and profitable forex trader.

FAQ

Is forex trading legal?

Yes, forex trading is legal in most countries if you use a regulated broker.