This software removes human delays in fast markets, where seconds cost money. It’s built for strategies like arbitrage, spotting price gaps between exchanges. But it needs coding skills and constant updates to dodge rules like SEC speed limits. Start on demos to avoid big losses. Pair with VPS hosting near data centers for a speed edge.

What Is High-Frequency Trading Software?

High-frequency trading software runs automated trades at speeds under a millisecond, analyzing live market feeds to execute orders. It connects to brokers for instant fills, often using protocols like FIX. A simple setup might scalp forex pairs on MetaTrader, while advanced ones backtest years of data. Expect 1000+ trades hourly on assets like S&P futures. Keep latency below 10ms for competitive fills. Always add fail-safes for sudden market drops.

Top High-Frequency Trading Software in 2025

These tools shine for speed, broker links, and testing features. They support backtesting on historical ticks and deploy with low lag. Each covers forex, stocks, or multiple assets, with free tiers for starters. Choose based on your setup: beginners want easy plug-ins, pros need open-source flexibility.

Interactive Brokers TWS

Interactive Brokers TWS gives traders access to more than 150 global markets with execution speeds below 10 milliseconds. It supports forex, stocks, futures, and options and provides multiple APIs for automation, including FIX, Web, and native TWS API. Traders can backtest strategies on tick-level data and even deploy them via cloud servers, making it a strong option for quants and professional traders.

Interactive Brokers TWS App Overview

Feature Details:

- Latency: <10ms

- APIs: FIX, TWS, Web

- Assets: 150+ markets

- Cost: Commission-based

Interactive Brokers TWS is ideal for algorithmic and institutional traders who value deep liquidity, global access, and advanced risk management tools within one reliable trading ecosystem.

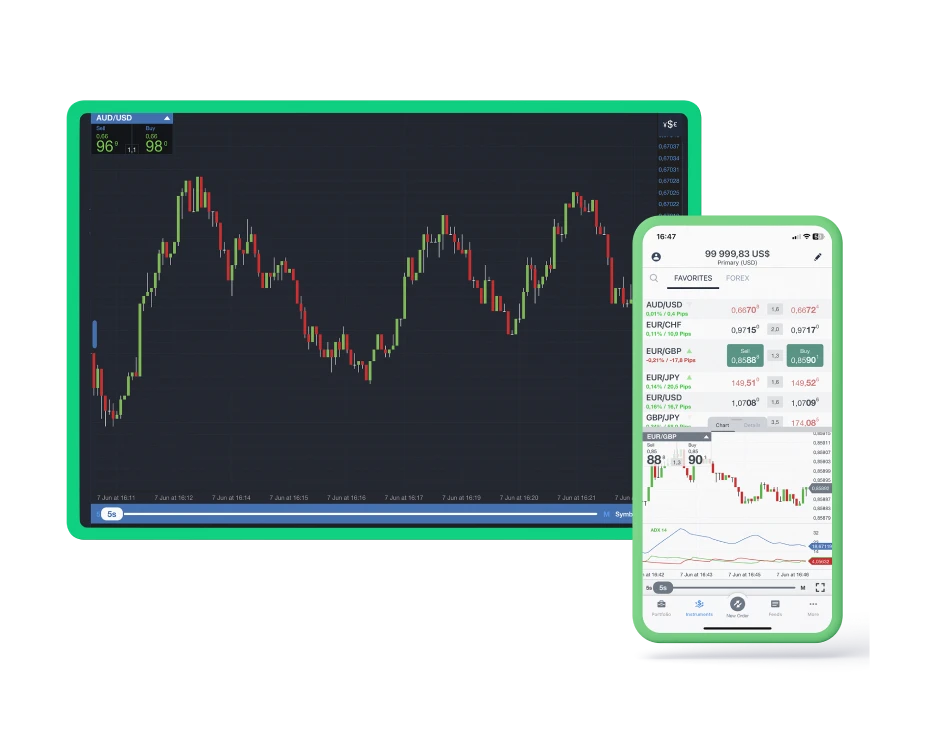

MetaTrader 5

MetaTrader 5 (MT5) supports 1,000+ instruments including forex, indices, and commodities. It’s a free platform known for its fast execution, automated Expert Advisors, and 99% accurate strategy testing. Traders can connect it to VPS hosting for non-stop trading, while multi-threaded performance allows smooth handling of complex strategies.

MT5 App Overview

Feature Details:

- Execution: Multi-threaded

- Indicators: 38 built-in

- Automation: Expert Advisors

- Market Access: Forex, CFDs, Stocks

MT5 is the go-to choice for both beginners and professionals using brokers like IC Markets or Exness, offering flexibility, speed, and precise control over algorithmic strategies.

cTrader

cTrader delivers ECN-style trading with Level II market depth and execution speeds under 20ms. It’s available through major brokers such as Pepperstone and FxPro, giving traders access to real market liquidity and transparent pricing. The platform integrates automated bots via cAlgo API and offers customizable templates for strategy development.

cTrader App Overview

Feature Details:

- Execution Speed: <20ms

- Trading Model: ECN

- Automation: cAlgo API

- Data Feed: Level II Depth

Designed for scalpers and technical traders, cTrader provides visual transparency, low spreads, and reliable order handling that help improve execution quality in volatile conditions.

QuantConnect

QuantConnect is a cloud-based algorithmic trading platform that allows users to build, backtest, and deploy strategies across forex, stocks, and crypto markets. It supports offers access to years of free historical tick data for testing.

QuantConnect App Overview

Feature Overview:

- Market Access: Forex, Stocks, Futures, Crypto

- Infrastructure: Cloud-based backtesting and live deployment

- Data Access: Extensive historical tick and market data

- Extra Tools: Community strategies and shared research hub

QuantConnect is perfect for coders and data-driven traders who want to prototype trading systems before connecting to live broker accounts. Its open-source design and collaborative community make it an innovation hub for automated trading research.

TradeStation

TradeStation provides a professional-grade environment for trading futures, forex, and stocks with execution below 50ms. It offers low-code automation tools, custom scanners, and backtesting on 20 years of market data. The monthly platform fee of $99 is waived for active users.

TradeStation App Overview

Feature Overview:

- Latency: <50ms

- Markets: Forex, Futures, Stocks

- Backtesting: 20 years of data

- Platform Fee: $99/month (waived for active traders)

TradeStation suits active traders looking to transition into automation. It blends real-time alerts, portfolio optimization, and solid historical testing for serious market participants.

NinjaTrader

NinjaTrader focuses on futures and tick-based trading strategies, supporting 30ms latency connections with CME data feeds. The simulator is free, while live trading starts from $99/month. It offers replay features, multi-broker access, and order flow visualization for deeper analysis.

NinjaTrader App Overview

Feature Overview:

- Account Types: Free Sim / Live

- Latency: 30ms

- Supported Brokers: Phillip Futures, Interactive Brokers

- Monthly Cost: $99

Best for futures and short-term traders, NinjaTrader gives users complete insight into market flow through its order book tools, helping fine-tune strategy execution in fast-moving conditions.

FXCM AlgoTerminal

FXCM AlgoTerminal integrates directly with MT4 and enables signal-based trading supported by live news feeds. Execution speed averages 50ms, and spreads begin from 0.2 pips. Traders with $5,000+ balances get free platform access, plus a no-code bot builder and 200+ pairs for algorithmic testing.

FXCM App Overview

Feature Overview:

- Spreads: From 0.2 pips

- Execution Speed: 50ms

- Automation: Built-in + API options

- Coverage: 200+ instruments

FXCM AlgoTerminal is an excellent choice for forex traders combining manual analysis with automation. It offers smart scanning for arbitrage and volume rebate programs that reward active trading.

How to Choose High-Frequency Trading Software

Selecting the right high-frequency trading (HFT) software can make or break performance in fast-moving markets. The key is to balance speed, stability, and broker reliability. Every millisecond counts, so the platform’s latency, server location, and execution method directly impact profitability. Professional traders often rely on dedicated APIs, optimized VPS servers, and backtesting systems that handle live tick data efficiently.

Checklist for choosing high-frequency trading software:

- Latency: Under 5ms for stocks and 20ms for forex execution

- API Support: Ensure compatibility with your preferred programming language (Python, C++, Java)

- Backtesting: Use updated tick data to prevent overfitting and false performance results

- VPS Location: Host servers near major hubs like NY4 or LD5, with costs starting around $20/month

- Slippage Control: Target slippage below 0.5 pips on major pairs for consistent execution

- Broker Integration: Choose platforms linked to regulated brokers for fund safety and compliance

High-frequency trading software should deliver consistent results under load, handle large order volumes, and maintain stable connectivity during volatility. Before going live, run extensive demo tests to fine-tune strategy execution and confirm real-time system performance.

Risks of High-Frequency Trading Software

Sudden crashes, like 2010’s $1T wipeout, hit margins fast. Coding errors can loop bad trades, emptying accounts overnight. Regulators fine spoofing—fake orders—up to $1M. High volumes raise fees; keep below $3/lot. Data glitches cause missed fills. Limit positions to 5% equity and set daily stop-loss caps.

Setting Up High-Frequency Trading Software

Choose an ECN broker like Pepperstone for raw data. Install MetaTrader 5, build a simple moving average bot. Rent a VPS in Equinix LD4 for $20/month, targeting 10ms pings. Test on 2024 tick data, aiming for 60% win rate. Start live with $10k, risking 0.5% per trade. Use dashboards to track; tweak weekly for market shifts.

Regulations for High-Frequency Trading in 2025

SEC’s CAT logs orders in 100ns to catch manipulation. EU MiFID II limits HFT on dark pools. ASIC bans retail latency arbitrage. Pros with $1M+ net worth get full access. Brokers track all trades for audits. Check compliance on FINRA BrokerCheck to avoid bans.

Hardware for High-Frequency Trading Software

High-end GPUs process data 10x faster than CPUs for $10k setups. Co-location in Chicago runs $2k/month for 1ms gains. SSDs store a year’s forex ticks on 1TB. Minimum 10Gbps bandwidth. Start free on cloud like Google Colab, upgrade to dedicated for live runs.

FAQ

What speed is needed for high-frequency trading software?

Under 50ms total; pros hit 1ms with co-location. Retail targets 20-30ms via VPS.