Many traders underestimate how much spreads affect their results. For example, if you trade 50 lots per month, even a 0.2-pip difference can save you hundreds of dollars. Low-spread brokers are especially useful for scalpers, day traders, and algorithmic traders who rely on speed and tight pricing. In this guide, we’ll go through the best low spread brokers that offer transparent pricing, fast execution, and stable conditions during high market volatility.

Top Low Spread Brokers in 2025

These brokers are well-known for their competitive spreads, strong regulation, and reliability. They are suitable for both beginners looking to save on trading costs and professionals who need raw spreads for higher-volume strategies.

List of Recommended Brokers:

IC Markets

IC Markets is one of the world’s leading ECN brokers. It connects traders directly to liquidity providers, which ensures real-time execution and very low spreads even during market news releases. It’s perfect for scalpers, EAs, and high-frequency traders who need speed and accuracy. The broker also supports multiple account types, including raw and standard accounts, depending on your trading volume.

IC Markets App Overview

Main Features:

- Regulation: ASIC, CySEC

- Spreads: From 0.0 pips (Raw ECN)

- Platforms: MT4, MT5, cTrader

- Commission: $3 per side

IC Markets offers stable performance across all sessions, 24/5 customer support, and fast deposits via cards, wallets, and bank transfers.

Pepperstone

Pepperstone is a top choice for traders seeking ultra-fast execution and minimal trading costs. It uses a low-latency network designed for speed, making it one of the best brokers for scalping and algorithmic trading. The spreads on major pairs like EUR/USD often remain near 0.0 even during active sessions.

Pepperstone App Overview

Main Features:

- Regulation: FCA, ASIC, DFSA

- Spreads: From 0.0 pips

- Platforms: MT4, MT5, cTrader

- Commission: $3.50 per lot

The broker offers excellent educational resources, market analysis, and 24/7 support. Pepperstone’s reputation for transparency and consistency makes it a safe option for all traders.

FP Markets

FP Markets provides institutional-grade ECN pricing and is highly respected for its low-cost structure. It’s a strong option for traders who want to combine low spreads with professional trading tools. The broker’s execution speed and order accuracy make it excellent for both retail and corporate clients.

FP Markets App Overview

Main Features:

- Regulation: ASIC, CySEC

- Spreads: From 0.0 pips

- Platforms: MT4, MT5, IRESS

- Commission: $3 per side

FP Markets also offers free VPS hosting for algorithmic traders and supports over 10,000 trading instruments, including forex, indices, and shares.

Tickmill

Tickmill is well-known for having one of the lowest commission structures in the industry. Its Pro and VIP accounts are designed for active traders who want the best execution and pricing possible. Tickmill also provides advanced analytics, market insights, and competitive rebates for high-volume traders.

Tickmill App Overview

Main Features:

- Regulation: FCA, CySEC, FSCA

- Spreads: From 0.0 pips

- Platforms: MT4, MT5

- Commission: $2 per side

The broker’s low-cost trading and transparent pricing make it an excellent option for experienced users who manage large portfolios.

FXTM

FXTM offers flexible spreads and affordable trading options for small investors. Its ECN account provides deep liquidity and fast execution speeds. FXTM’s easy interface, educational content, and local payment methods make it ideal for beginners.

FXTM App Overview

Main Features:

- Regulation: FCA, CySEC

- Spreads: From 0.1 pips

- Platforms: MT4, MT5

- Commission: From $0.40 per $1,000 traded

Professional traders can also benefit from low commissions and customizable account options. The broker’s technology ensures steady performance, even during high volatility.

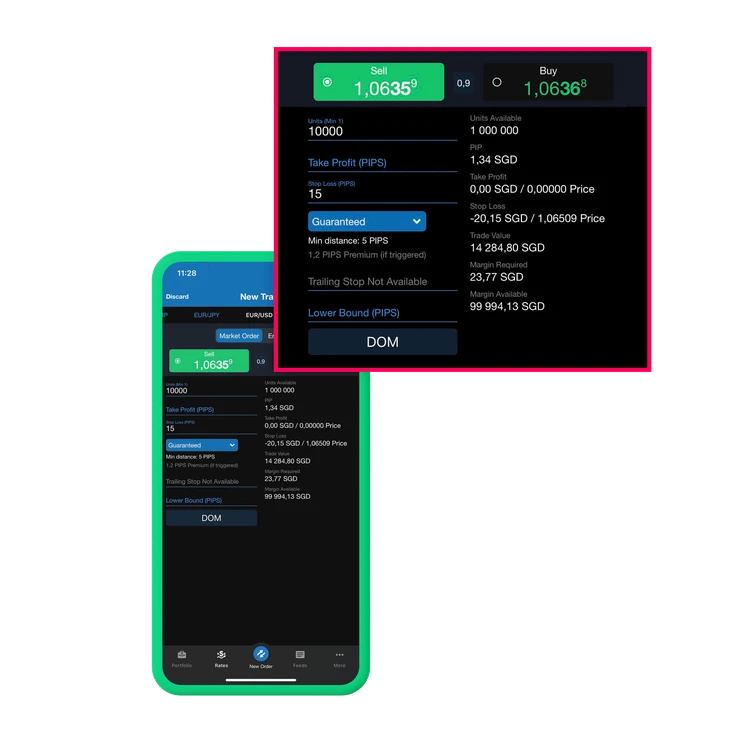

XM

XM combines low-cost trading with global accessibility. It offers multiple account types, from micro to ultra-low, allowing traders to select what fits best. XM’s spreads stay stable during all market sessions, making it a good choice for consistent trading.

XM App Overview

Main Features:

- Regulation: ASIC, CySEC

- Spreads: From 0.6 pips

- Platforms: MT4, MT5

- Commission: None (spread-based model)

It also provides negative balance protection and an excellent support system for clients in over 190 countries.

Why Spreads Are Important in Forex

The spread is a hidden trading cost that affects every position. Even if you don’t pay a direct commission, spreads determine how much you pay when opening a trade. Lower spreads mean you enter and exit trades closer to the actual market price.

If your broker charges a 2-pip spread on EUR/USD, you start each trade at a small loss. If another broker offers 0.2 pips, your potential profit starts earlier. Over time, this can add up to hundreds or thousands of dollars in savings.

How to Identify a True Low-Spread Broker

Not every broker that advertises “zero spreads” truly offers tight pricing under real market conditions. Many promote 0.0 pips in marketing materials, but in practice, those spreads appear only during specific high-liquidity moments. To separate reliable brokers from misleading ones, traders need to assess transparency, regulation, and execution quality. A legitimate low-spread broker will clearly display its pricing model, offer ECN or Raw accounts, and operate under the supervision of a reputable financial authority.

- Check the account type: Raw or ECN accounts usually have the lowest spreads.

- Monitor spreads in real time: Some brokers only advertise 0.0 pips but rarely deliver.

- Verify regulation: Always trade with a licensed broker under a known authority.

- Understand commissions: Some brokers replace spreads with small per-trade commissions.

- Trade during active hours: Spreads widen during low liquidity sessions.

Evaluating spreads should go beyond marketing claims. True low-spread brokers combine tight pricing with transparency, consistent execution, and no hidden markups. Always test real-time conditions through a demo or small live account before committing significant funds — this ensures you’re trading under the broker’s true pricing structure, not just the advertised one.

Trading Tips for Low Spread Accounts

Trading with low-spread accounts can be highly effective when combined with proper risk management and timing. These accounts are best suited for active traders who execute multiple short-term positions throughout the day. However, even small price movements can have a significant impact when spreads are tight, so understanding how to manage execution, slippage, and liquidity is essential. To get consistent results, traders should focus on liquidity hours, use proper order types, and maintain control over their margin and exposure.

- Use limit orders to avoid slippage during volatile periods.

- Stick to major currency pairs such as EUR/USD and GBP/USD.

- Avoid trading right after news releases when spreads can expand.

- Keep enough margin to prevent unexpected stop-outs.

- Test each broker’s real conditions with a demo account first.

Consistent monitoring and choosing the right sessions (London and New York overlap) can significantly improve trading results.

Common Myths About Low Spreads

Low spreads often attract traders searching for cost-effective ways to enter and exit the market, but misconceptions can cloud judgment. Many assume that tight spreads automatically mean better profits or riskier trading environments, but that’s not always true. Let’s clarify some widespread misunderstandings about low-spread trading conditions so you can make smarter decisions.

- Myth 1: Low spreads mean lower quality — False. Regulated ECN brokers can offer 0.0 spreads due to high liquidity.

- Myth 2: All brokers with “zero spreads” are the same — False. Some use markups or slower execution.

- Myth 3: Low spreads guarantee profit — False. Strategy, discipline, and timing still matter most.

While low spreads are appealing, they’re only one part of a larger picture. A good broker combines competitive pricing with transparent execution, regulation, and reliable support. Always compare spreads alongside trading conditions, commissions, and execution quality before opening an account.

FAQ

What are low spreads in forex trading?

Low spreads mean smaller price differences between buying and selling — typically between 0.0 to 1.0 pips.