What Is MetaTrader 5?

MetaTrader 5 is a multi-asset trading platform developed by MetaQuotes. It offers advanced charting, automated trading through Expert Advisors (EAs), and support for forex, stocks, futures, and cryptocurrencies. MT5 stands out for its fast order execution, customizable interface, and tools like depth of market (DOM) and economic calendars. It’s ideal for traders who need robust analytics and access to diverse markets.

Top MetaTrader 5 Brokers for 2025

Selecting a reliable MT5 broker ensures smooth trading and access to essential tools. The brokers below are chosen based on their reputation, low fees, regulation, and MT5-specific features. Each offers a solid platform for traders of all levels.

IC Markets

IC Markets is a leading MT5 broker known for its low spreads and fast execution. Regulated by ASIC, CySEC, and the FSA, it’s a trusted choice for traders globally. The broker supports forex, indices, commodities, and cryptocurrencies on MT5, with spreads starting from 0.0 pips on major pairs.

IC Markets App Overview

Key Features: Raw spread accounts, 1:500 leverage, no requotes.

Why Choose It: IC Markets is ideal for scalpers and high-volume traders due to its tight spreads and reliable execution. Its MT5 platform supports algorithmic trading and offers a wide range of markets, making it versatile for advanced strategies.

Pepperstone

Pepperstone, regulated by ASIC, FCA, and CySEC, is popular for its competitive pricing and robust MT5 platform. It offers access to over 1,200 instruments, including forex, CFDs, and crypto, with low-latency execution.

Pepperstone App Overview

Key Features: Spreads from 0.0 pips, 1:400 leverage, 24/5 support.

Why Choose It: Pepperstone’s MT5 platform is perfect for traders who value speed and flexibility. Its strong regulatory framework and diverse asset selection make it a reliable choice for both new and seasoned traders.

FP Markets

FP Markets combines competitive pricing with a feature-rich MT5 platform. Regulated by ASIC and CySEC, it offers access to forex, equities, commodities, and indices, with spreads starting at 0.0 pips.

FP Markets App Overview

Key Features: ECN pricing, 1:500 leverage, VPS for automated trading.

Why Choose It: FP Markets is great for traders who use Expert Advisors, thanks to its support for algorithmic trading and low-cost structure. Its transparent pricing and reliable execution make it a strong contender.

XM

XM is known for its beginner-friendly approach and strong MT5 offering. Regulated by ASIC, CySEC, and IFSC, it provides access to over 1,000 instruments, including forex, stocks, and commodities.

XM App Overview

Key Features: Spreads from 0.6 pips, 1:888 leverage, free educational resources.

Why Choose It: XM is perfect for new traders due to its low minimum deposit and extensive learning materials. Its MT5 platform supports all trading styles, with fast execution and no hidden fees.

AvaTrade

AvaTrade, regulated by multiple authorities like ASIC, FSCA, and CBI, offers a user-friendly MT5 platform with a focus on forex, stocks, and cryptocurrencies. It’s known for its fixed spreads and robust trading tools.

AvaTrade App Overview

Key Features: Fixed spreads from 0.9 pips, 1:400 leverage, social trading integration.

Why Choose It: AvaTrade suits traders who prefer predictable costs and a smooth MT5 experience. Its copy-trading feature and educational support make it ideal for those starting out or diversifying their strategies.

Admiral Markets

Admiral Markets, regulated by FCA, ASIC, and CySEC, offers a robust MT5 platform with access to forex, stocks, and commodities. It’s known for its advanced trading tools and competitive pricing.

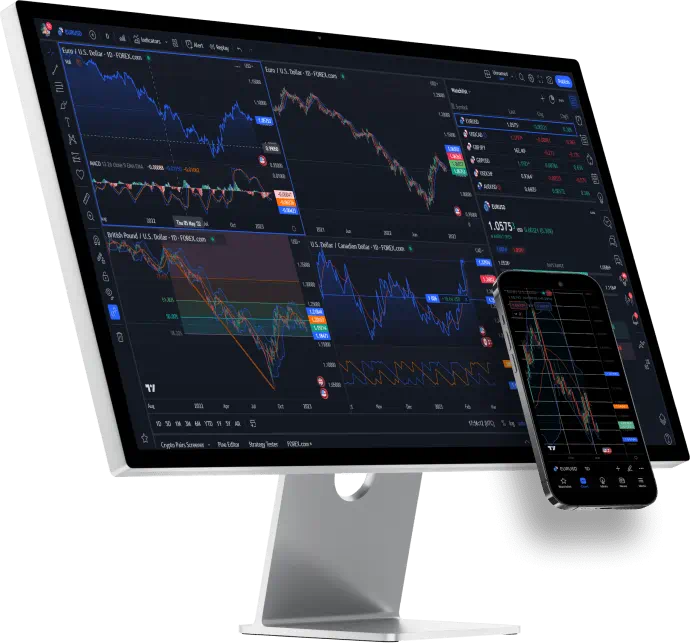

Admiral Markets App Overview

Key Features: Spreads from 0.5 pips, 1:500 leverage, negative balance protection.

Why Choose It: Admiral Markets is great for traders who want advanced analytics and a reliable MT5 platform. Its educational resources and market analysis tools help traders make informed decisions.

Benefits of Trading with MT5

MT5 is designed for both beginners and professionals who need flexibility and precision. It supports multiple assets — forex, stocks, indices, commodities, and cryptocurrencies — all from a single account. Its Depth of Market (DOM) shows live liquidity levels, while advanced charting tools and Expert Advisors (EAs) allow for automated trading.

Why traders prefer MT5:

- Multi-asset access: trade forex, crypto, and stocks together.

- Built-in economic calendar with live market news.

- 21 timeframes and 80+ indicators for advanced analysis.

- Faster execution compared to MT4.

- Support for algorithmic trading and backtesting.

The platform’s combination of speed, flexibility, and automation makes it ideal for scalping, swing trading, and long-term investing.

Common Mistakes to Avoid with MT5 Brokers

Even with a good platform, choosing the wrong broker can lead to losses. Many traders make errors by skipping research or chasing bonuses from unregulated brokers.

Common mistakes include:

- Ignoring broker regulation and credibility.

- Overlooking hidden fees such as withdrawal or inactivity charges.

- Using brokers with slow execution or frequent server downtime.

- Failing to test the broker’s MT5 demo before live trading.

Avoiding these mistakes helps you trade safely and maintain consistent execution. Always prioritize regulated brokers with transparent pricing and solid infrastructure.

Tips for Maximizing MT5’s Features

To make the most of MT5, use its technical and analytical tools wisely. Customization and automation are key to efficient trading.

Best practices for using MT5 effectively:

- Set up custom indicators and Expert Advisors (EAs) for automated strategies.

- Use the economic calendar to prepare for major market events.

- Apply stop-loss and take-profit orders to manage risk.

- Backtest your strategies using MT5’s historical data before going live.

- Monitor your performance with the trading journal feature.

By combining proper broker selection with MT5’s advanced features, traders can achieve faster execution, lower costs, and a more structured trading approach. Consistent testing and disciplined risk management are the keys to long-term success.

FAQ

What is MetaTrader 5?

MT5 is a multi-asset trading platform for forex, stocks, commodities, and cryptocurrencies, offering advanced charting, automated trading, and fast execution.