What Is Trading Central

Trading Central is a financial data provider that delivers real-time market research and trading ideas. It covers forex, stocks, indices, commodities, and cryptocurrencies. The service gives traders clear entry and exit points, price forecasts, and market trends based on technical and fundamental analysis.

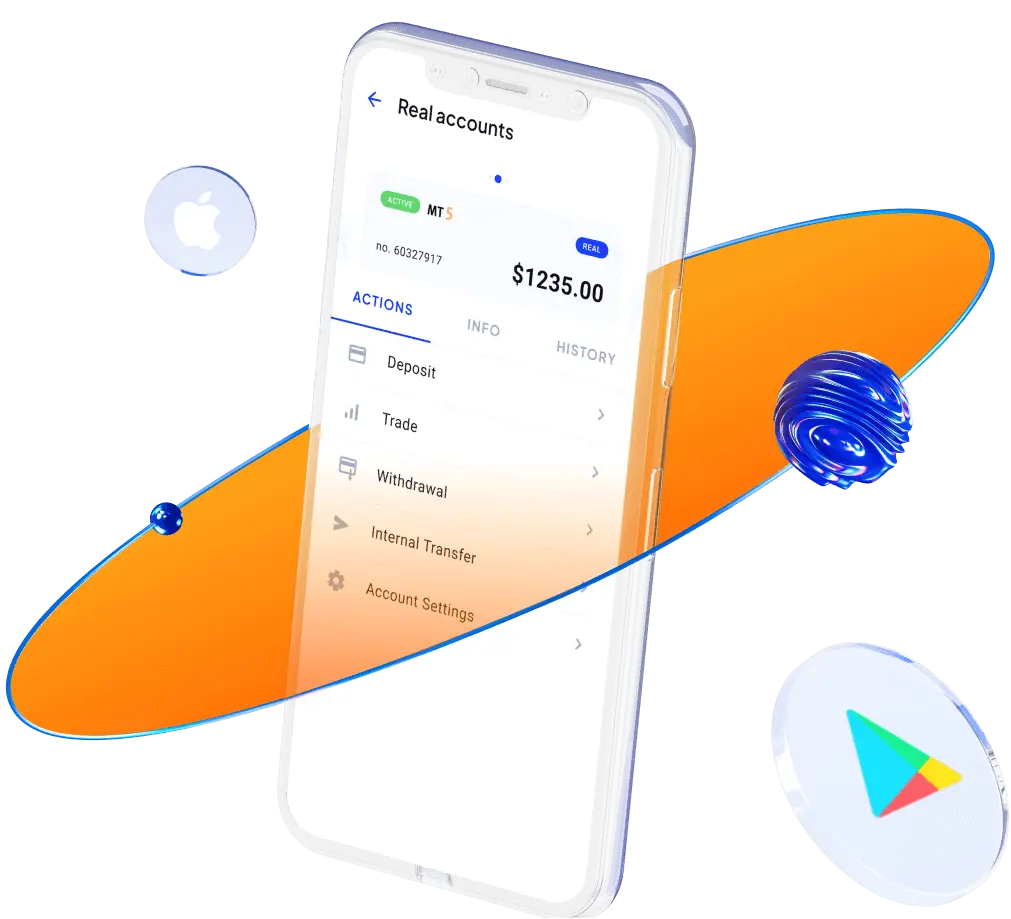

This tool is available directly on supported brokers’ platforms or through MetaTrader plugins, mobile apps, and web dashboards.

Using Trading Central, you can see when markets are overbought or oversold, spot important chart patterns, and track how global events affect price movements. It’s a trusted partner for traders who want accurate, data-based signals.

Top 5 Trading Central Brokers

Here’s a list of reliable brokers that give full access to Trading Central tools, including market analysis, trading signals, and economic updates. These platforms are licensed, trusted, and known for quality execution and customer service.

XM Broker

XM offers clients a direct connection to Trading Central through both the web platform and MetaTrader 4/5.

Main features:

- Technical analysis for all major instruments

- Daily market updates and reports

- Price movement alerts and forecasts

- Economic calendar and trading ideas

XM is suitable for both beginners and professionals. It’s known for tight spreads, quick order execution, and detailed educational content. The broker combines research, practical tools, and client support to create a balanced trading experience.

FxPro

FxPro gives free access to Trading Central insights for all clients. The broker’s goal is to provide powerful analysis tools to support smart trading decisions.

Main features:

- Market forecasts and signal updates

- Visual chart analysis and trend recognition

- News feed with economic data

FxPro’s advanced infrastructure and multiple trading platforms make it a great choice for both short-term and long-term trading. Users appreciate the mix of research tools, liquidity, and fast execution.

Pepperstone

Pepperstone connects users with Trading Central via its Smart Trader Tools plugin, available for MT4 and MT5.

Main features:

- Strategy ideas from Trading Central experts

- Custom technical analysis indicators

- Market sentiment and news scanner

- Integration with Autochartist

Pepperstone is a regulated broker that supports professional tools, deep liquidity, and responsive support. It’s suitable for both manual traders and those using automated systems, helping them refine strategies using Trading Central data.

AvaTrade

AvaTrade gives clients Trading Central analysis through its AvaTradeGO app and web platforms.

Main features:

- Visual signals and chart patterns

- Daily news and market summaries

- Trading signals for forex, stocks, and crypto

- Available in multiple languages

AvaTrade focuses on education and accessibility. The broker combines global regulation, competitive trading conditions, and simple access to research tools, helping traders improve their market understanding and performance.

How to Choose a Trading Central Broker

When selecting a broker that offers Trading Central, check these factors:

- License and regulation: Always trade with verified brokers.

- Fees and spreads: Compare trading costs for your preferred assets.

- Trading platform: Choose one that integrates Trading Central easily.

- Support quality: Make sure help is available 24/7.

- Research access: Confirm the broker offers full Trading Central access, not limited features.

Choosing the right broker saves time and gives you a smoother, more informed trading experience.

Advantages of Using Trading Central

Trading Central is popular for several reasons:

- Offers professional-grade analysis and signal accuracy.

- Covers multiple asset types in one place.

- Helps identify trends before the market moves.

- Improves trading discipline with real data and alerts.

- Saves time by summarizing daily opportunities.

The main benefit is consistency — traders get reliable data without the noise and bias found in unverified sources.

Practical Steps to Use Trading Central Tools

Trading Central offers valuable insights that combine professional analysis with automated signals, helping traders make better decisions every day. To get the most from it, follow these simple, actionable steps:

- Log in to your broker’s client area and open the Trading Central section.

- Check daily updates on your preferred instruments — forex, stocks, or commodities.

- Compare signals with your own technical or fundamental analysis to confirm trade direction.

- Set stop-loss and take-profit levels as suggested by the analysis, adjusting them to your risk tolerance.

- Track performance by reviewing trades weekly and noting how Trading Central’s signals perform.

Additional practical tips:

- Use Trading Central signals only as confirmation, not the sole reason for entering trades.

- Combine the tool with MT4/MT5 chart analysis for better accuracy.

- Activate email or app notifications to stay updated on trade setups.

- Review the support/resistance zones highlighted in reports to fine-tune entries.

- Keep a trading journal to measure how often Trading Central signals align with your strategy.

Trading Central works best when used as part of your personal trading plan, supporting decision-making rather than automating it. It helps you make informed moves without losing control of your strategy.

Why Trading Central Matters for Beginners

New traders often struggle to interpret charts and filter meaningful signals from noise. Trading Central simplifies this process by providing clear, professional analysis. It highlights entry and exit levels, identifies potential reversals, and explains why certain market setups are worth attention — giving beginners a structured way to learn market behavior.

Benefits for new traders include:

- Ready-to-use chart setups with clear visual explanations.

- Real-time updates on trend changes and price targets.

- Educational notes that explain technical patterns like breakouts or double tops.

- Helps beginners see how professionals combine indicators and market sentiment.

Over time, using Trading Central builds a strong foundation in both technical and fundamental analysis. By reviewing signals and understanding the logic behind them, beginners can develop their own methods, improve timing, and trade more confidently.

FAQ

What is the main purpose of Trading Central?

It helps traders analyze financial markets and find better trade opportunities based on real data.