Selecting the right trading platform is the first and most important step for new traders in India. A good platform should be easy to use, secure, and provide reliable market data. Many beginners lose money not because of poor strategy but because they choose platforms with hidden fees or unstable systems. Understanding what to look for helps save time and protects investment capital.

Key Features of a Good Trading Platform

A reliable trading platform is the foundation of successful forex or stock trading. The right platform should be stable, user-friendly, and equipped with all the tools needed to analyze markets and execute trades efficiently. A poor platform can cause missed opportunities, delayed orders, or even financial loss due to technical glitches. Traders should always test a platform before depositing funds to ensure it matches their strategy and trading style.

Easy-to-Use Interface

The best trading platforms offer an intuitive interface that’s easy to navigate even for beginners. A clear layout helps traders place orders quickly, view live charts, and manage positions without confusion. Essential tools like order types, indicators, and price alerts should be easily accessible from one dashboard. A good platform also allows customization, so traders can set up charts, watchlists, and alerts according to personal preferences. Simplicity combined with functionality helps improve efficiency and decision-making during fast market movements.

Fast Execution and Stability

Execution speed is one of the most critical factors in trading. Even a small delay of one or two seconds can make a big difference in volatile forex markets. Reliable platforms process orders instantly and remain stable during peak trading hours. Always test execution speed on demo accounts and observe how the platform performs during news events or high volatility. A system with consistent uptime, minimal lag, and smooth order confirmation provides a strong edge in fast-moving markets.

Security and Regulation

Security and regulatory compliance should always be top priorities when choosing a trading platform. With online trading involving sensitive data and real money, traders must ensure the platform follows strict legal and security standards.

In India, all trading platforms must operate under SEBI (Securities and Exchange Board of India) regulations or through authorized brokers connected to regulated exchanges like NSE, BSE, or MCX-SX. Forex platforms must comply with RBI guidelines and restrict trading to INR-based currency pairs. Using regulated platforms ensures fund safety, transparency, and access to legal recourse in case of disputes. Always verify the broker’s SEBI registration number on the official website before creating an account.

A secure trading platform uses strong encryption technology to protect user data, login credentials, and financial transactions. Look for brokers that offer two-factor authentication (2FA), SSL encryption, and regular security audits. Avoid unverified apps or those with poor online reviews, as they can compromise personal data or misuse banking information. Platforms that maintain transparency about their security policies demonstrate trustworthiness and reliability.

Popular Trading Platforms in India

India offers several SEBI-regulated platforms that combine safety, performance, and accessibility. Each one caters to different types of traders — from beginners to professionals.

- Zerodha Kite – Popular for stock and commodity trading with a simple interface and advanced charting tools.

- Groww – Beginner-friendly platform designed for stocks, ETFs, and mutual funds, ideal for new investors.

- Angel One (Angel Broking) – Offers both mobile and web trading platforms with smart order tools and portfolio tracking.

- Upstox – Known for low brokerage fees, real-time charts, and seamless mobile trading experience.

These platforms are widely trusted in India and operate under SEBI oversight, making them safe choices for traders who value transparency and efficiency.

Platform Comparison

| Platform | Type | Best For | Regulation |

|---|---|---|---|

| Zerodha Kite | Stock, Futures | All traders | SEBI |

| Groww | Stocks, ETFs | Beginners | SEBI |

| Angel One | Stocks, Forex | Mixed traders | SEBI |

| Upstox | Stocks, Options | Low fees | SEBI |

Each platform has its own strengths. Zerodha is known for speed and technical tools, Groww for ease of use, Angel One for research support, and Upstox for cost efficiency. Before selecting one, traders should compare features like account fees, chart tools, customer support, and execution speed.

Choosing the Right Platform for Forex

Selecting the right forex trading platform is one of the most important steps for every trader. In India, it’s not only about finding a platform with good features but also ensuring that it follows legal guidelines set by SEBI and RBI. A reliable platform should provide transparent pricing, quick execution, and access to authorized INR-based trading pairs. It should also offer strong customer support and easy fund management options for Indian users.

Legal Trading Options in India

Forex trading is legal in India only through SEBI-registered brokers and recognized exchanges such as NSE, BSE, and MCX-SX. Traders are allowed to trade only INR-based currency pairs — USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading non-INR pairs or using international forex apps is considered illegal under FEMA (Foreign Exchange Management Act). Always confirm the broker’s registration on SEBI’s official site before depositing funds. Legal brokers also ensure that all transactions go through Indian banks, protecting you from fraud and compliance issues.

Key Forex Platforms

When choosing a forex broker or platform, focus on functionality, legal status, and user convenience. Look for brokers that provide MetaTrader 4 (MT4) or MetaTrader 5 (MT5) — these platforms are industry standards for both beginners and professionals. Mobile compatibility is also crucial, allowing traders to monitor and manage positions on the go. Choose brokers that support INR deposits via UPI, NetBanking, or direct transfer for easy fund movement. A good platform should combine local accessibility with global-grade trading technology.

Cost and Brokerage Comparison

Understanding trading costs helps you avoid hidden charges and maximize profitability. Every platform has its own fee structure, which can affect overall returns, especially for small-capital traders.

Types of Charges

- Brokerage fees – Commission per trade or as a spread markup.

- Deposit/withdrawal fees – Charged for transferring money to and from your account.

- Maintenance charges – Monthly or yearly fees for account upkeep or inactivity.

Comparing these costs across platforms helps find one that matches your budget and trading frequency. For new traders, it’s best to start with brokers offering zero or low brokerage plans to minimize expenses. Some platforms even offer promotional free trading for the first few months. Avoid brokers that impose inactivity fees, as they can eat into your balance during periods when you’re not trading. Always read the fee disclosure section on the broker’s website before signing up to ensure full transparency.

Trading Tools and Learning Support

A good trading platform not only helps execute trades but also educates users and supports analysis. Having the right tools built into your platform can make a big difference in accuracy and confidence.

- Real-time charts and indicators – For tracking live price movements and identifying opportunities.

- Economic calendar – Keeps traders informed about important market events and data releases.

- Demo account for practice – Allows testing strategies without risking real money.

- Customizable alerts – Notify traders about price changes or trend shifts automatically.

These tools make trading more efficient and help traders make better decisions based on live market data. Learning support is equally important, especially for beginners. Platforms like Zerodha Varsity, Angel One Academy, and Upstox Learn offer free educational materials, covering topics like technical analysis, fundamental trading, and risk management. Many brokers also host webinars, tutorials, and community discussions to help traders understand market behavior in real time. Continuous learning through these resources helps build strong foundations and prepares traders for advanced trading setups.

Customer Support and Accessibility

Reliable customer support is a key feature of a trustworthy trading platform. Forex trading runs 24 hours a day, so traders need quick assistance whenever technical or financial issues occur. A strong support system ensures smooth trading, faster problem resolution, and greater confidence when managing funds. In India, platforms that offer multilingual support — including English and regional languages — help users communicate more effectively.

Responsive customer service can make a major difference in your trading experience. Look for platforms that offer 24/7 live chat, email, and phone support. Many brokers also provide help through WhatsApp or in-app chat, which is faster and more convenient. Good customer support should handle trade execution errors, deposit delays, withdrawal queries, and technical bugs quickly. Before registering, test the broker’s response time by contacting them with a question — this helps you judge reliability before investing real money.

For Indian traders, accessibility means easy fund management. Choose platforms that support Indian bank transfers, UPI, Paytm, and NetBanking for deposits and withdrawals. Using local payment gateways ensures faster processing and compliance with RBI regulations. Avoid brokers that only allow international transfers or crypto deposits, as these are often unregulated and risky. Verified local payment options keep transactions transparent and protect your money from cross-border issues.

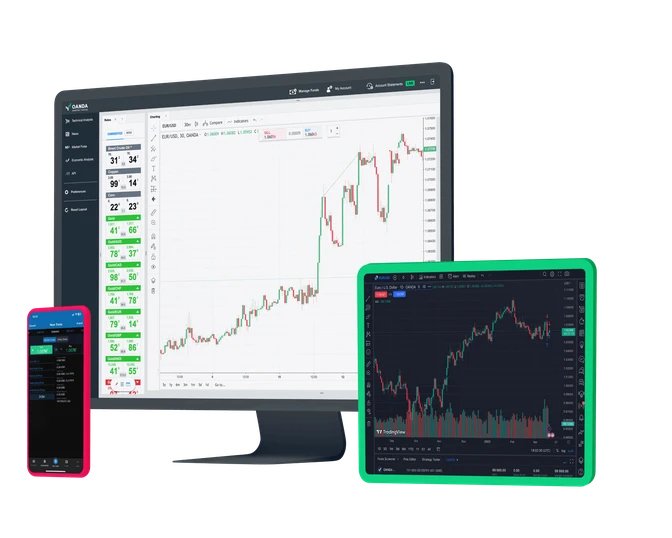

Mobile vs Desktop Platforms

Modern traders need flexibility, and that’s why most brokers now offer both mobile and desktop versions of their platforms. Each has its advantages — mobile trading is convenient for quick monitoring, while desktop versions provide detailed tools for analysis and strategy development.

Mobile Trading Benefits

Mobile apps make it easy to track the market, manage trades, and receive alerts anywhere, anytime. They are perfect for part-time or on-the-go traders who want to stay updated with live prices and quick order execution. Advanced apps like MetaTrader 5 Mobile, Zerodha Kite App, and Upstox Pro offer all essential features, including one-click trading, chart customization, and push notifications. Always ensure the app is secure, regularly updated, and compatible with your device.

Desktop Platforms for Analysis

Desktop platforms are ideal for traders who prefer detailed analysis and advanced tools. They provide multi-window chart layouts, customizable indicators, and in-depth reporting. Professional traders often use dual-monitor setups to compare multiple currency pairs or timeframes simultaneously. Desktop versions also allow easier use of Expert Advisors (EAs), algorithmic trading scripts, and backtesting tools, making them more suitable for full-time traders or analysts.

Step-by-Step to Start Trading in India

Getting started in forex or stock trading is simple if you follow the right steps. Starting small, staying compliant, and building knowledge gradually are the best ways to grow safely.

- Open a demat and trading account with a SEBI-registered broker.

- Choose a regulated platform that supports INR-based forex pairs.

- Learn basic chart reading and practice on demo accounts.

- Start with small capital — even ₹5,000–₹10,000 is enough to begin.

- Use stop-loss and take-profit orders to control risk and protect profits.

Following these steps ensures that your trading journey starts safely and legally under Indian regulations. Never rush to scale up your trading account. Increase trade size only after achieving consistent profits for several months. Focus on improving analysis, emotional control, and record-keeping before committing larger funds. Once you fully understand how the platform works and how markets move, you can expand your capital confidently. Gradual progress helps prevent large losses and builds the discipline needed for long-term trading success in India’s regulated environment.

FAQ

Which trading platform is best for beginners in India?

Zerodha, Groww, and Angel One are the best platforms due to low fees and easy interfaces.