Using a demo trading app is a smart move when you’re new to markets. You open the app, get virtual money, place trades in real-market conditions but without risking your own funds. For example, you might pick a forex pair like EUR/USD or a crypto asset like Bitcoin, set a simple rule (buy when the 50-day moving average crosses above the 200-day), and run 20 trades over a week in the demo app. At the end of the week you review how many trades hit your target, how many hit stop-loss, how your execution times were, and how comfortable you felt using the interface. That gives you real data before you move to live trading.

Why Use a Demo App

A demo app allows you to place trades without using your own funds. You get virtual capital, make entries and exits in real-time markets, and see how your decisions play out. This means you can make mistakes and learn from them without financial pain.

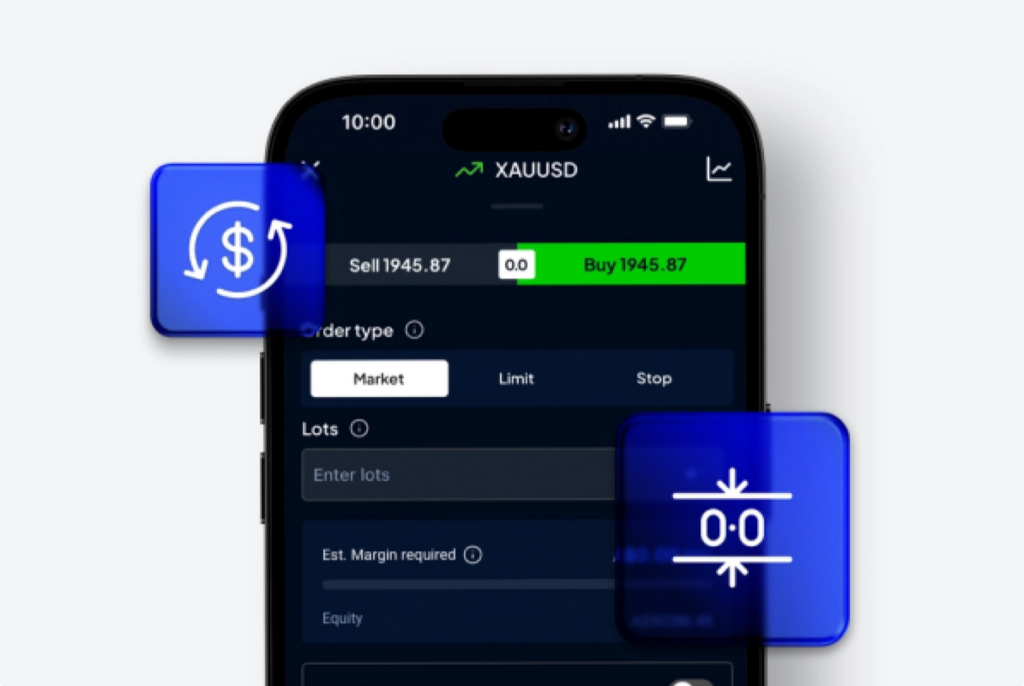

In the demo you familiarise yourself with chart tools, indicators, order types (market, limit, stop-loss), account interface, and trade execution. You can also experiment with volatility, see how spreads widen, and how latency affects results. Guides emphasise the value of demo trading for platform practice.

Setting Up Your Demo Trading Environment

Before starting demo trading, it’s essential to create a setup that feels as close to real trading as possible. Your environment should include a reliable internet connection, a quiet workspace, and a stable device with a clear display for charts and order placement. Choose a regulated platform that offers a demo mode with full access to indicators, charts, and order types — such as MetaTrader 4/5, TradingView, or CoinDCX demo tools. Set up your preferred timeframes, watchlists, and layout the same way you would in a live account. This helps build habits and familiarity with your tools. Keep your notifications on to track trade alerts and market updates. Treat this demo setup seriously — the more realistic your environment, the better prepared you’ll be when transitioning to live trading.

Choose the right app

Look for a demo app or demo mode in a trading platform that offers realistic market data, includes the instruments you plan to trade (forex, crypto, stocks), and offers features like stop-loss and limit orders. Many brokers list these in their demo account descriptions.

Setup trade rules and journal

Before you begin trading in demo mode:

- Define your strategy: entry signal, stop-loss, profit target, instrument.

- Set your virtual capital to match what you’d use live (e.g., ₹50,000).

- Create a trading journal (spreadsheet) with columns: Date, Instrument, Entry price, Stop-loss, Target, Result, Comments (emotions, mistakes).

Run this journal for each trade while you use the demo app.

Practice Routine and Metrics to Track

A consistent practice routine builds structure and discipline, which are essential for improving trading accuracy over time. By following a daily and weekly schedule, traders can stay focused, test strategies, and understand their decision-making patterns. Treat your demo period as real trading — this is the stage to fix mistakes and build good habits before using live money. Regular tracking helps measure what’s improving and what still needs work.

Set a simple routine:

- Log in the demo app, check your watch-list of instruments.

- Place trades when your strategy condition is met.

- After market close: record results and note what you did well and what you didn’t.

Do this for 5 trading days/week and aim for at least 30-50 demo trades.

Key metrics to monitor

Tracking the right data allows you to measure strategy quality and make data-based improvements. Each metric gives insight into how effective, consistent, and realistic your trading plan is.

| Metric | Why it matters |

|---|---|

| Win rate (wins / total) | Shows effectiveness of your strategy |

| Average profit per trade | Measures how much you gain vs how much you risk |

| Maximum draw-down | Indicates how bad a losing streak can get |

| Execution time / slippage | Reveals if demo environment diverges from live conditions |

Transitioning From Demo to Live Trading

You should consider going live when: you’ve done at least 30-50 demo trades, your journal shows consistent results (for your defined period), you’re comfortable with platform operations, and you understand your emotional reactions to wins/losses.

- Use real money but start small (e.g., 10-20 % of what you used in demo).

- Expect differences: slippage, liquidity, emotional pressure. Studies note that demo results often differ from live.

- Keep using your journal and track live metrics side-by-side with demo ones.

Making the Most of Demo App Features

Demo trading apps are one of the safest and most effective tools for building real trading skills without financial risk. They replicate live market conditions using virtual funds, allowing beginners to practice strategies, explore order types, and understand how price changes affect profits and losses. Treating demo trading seriously helps you develop confidence before switching to live accounts. The more you use these demo tools correctly, the smoother your transition to real-money trading will be.

Use All Available Tools

Most demo apps today include full-featured dashboards similar to real trading platforms. Take advantage of everything — from technical indicators like RSI, MACD, and Moving Averages to charting tools for marking support and resistance levels. Learn how to use different order types such as limit, stop-loss, and trailing stop orders, and understand how each behaves during fast-moving markets.

You can also test trade management options, like partial exits or stop adjustments, which help control losses and secure profits. Spend time exploring app settings, chart timeframes, and data views — the goal is to become fully comfortable navigating the platform before you risk real capital.

Simulate Real Risk

A demo account should mirror your real trading conditions as closely as possible. Set your trade size, stop-loss, and target levels exactly as you plan to use them in live trading. Pretend that every trade in your demo has real financial consequences — this mindset trains your emotional control and decision-making under pressure.

The more seriously you treat your demo practice, the stronger your risk management habits and mental discipline become — two key traits that separate consistent traders from emotional ones.

Review and Improve Continuously

At the end of each week: review your journal, calculate your metrics (win rate, average profit/loss, draw-down), list mistakes and identify areas for improvement. Then tweak your strategy or execution accordingly.

Long-term improvement plan

After 2-3 months of demo trading:

- Identify your style (short-term, swing, long-term).

- Decide if you want to test another instrument class (e.g., add crypto if you were trading forex).

- Evaluate whether you need better charting tools or a different platform.

FAQ

What is a demo trading app?

It’s an application or platform mode where you trade using virtual money but live market data. You can practice trades without risking your own funds.