Forex trading apps in India now support INR pairs like USD/INR, EUR/INR, GBP/INR, and JPY/INR through NSE, BSE, and MSE exchanges. These apps deliver real-time prices, instant order execution, and portfolio tracking on Android and iOS devices. Daily turnover on currency derivatives crossed ₹1.8 lakh crore in 2024, up 40% from the previous year. Users place futures and options contracts expiring monthly or weekly, with settlement in rupees only. All transactions stay within RBI limits of $250,000 per year for individuals under the Liberalised Remittance Scheme.

Safety starts with SEBI registration and bank-grade encryption. Download Zerodha Kite and Upstox Pro. Open demo accounts with ₹50,000 virtual funds each. Trade USD/INR futures for 10 days, placing 5 orders daily between 9:15 AM and 4:45 PM IST. Record entry price, exit price, and slippage in a spreadsheet. Compare execution speed during 11:00 AM–12:00 PM (peak volume) versus 3:00 PM. This drill shows which app fills orders faster when volatility spikes after US data releases at 6:00 PM IST.

Legal Rules for Forex Apps in India

RBI prohibits spot forex and CFDs for retail users. Only currency derivatives on recognized stock exchanges are allowed. FEMA violations trigger penalties up to three times the transaction value plus imprisonment.

SEBI Registration Process

Brokers file Form A with SEBI, pay ₹10 lakh fee, and maintain ₹25 crore net worth. Registration lasts 3 years; renewal needs clean audit reports.

Banned Activities List

- Trading EUR/USD on offshore platforms

- Using VPN to access MetaTrader with foreign brokers

- Remitting funds above LRS limit for margin

Visit nseindia.com → Member List → Currency Segment. Download the PDF. Cross-check five app names. Note their membership codes and start dates.

Top SEBI-Registered Forex Apps

All listed apps clear trades through exchange clearing corporations, eliminating counterparty risk.

| App | Parent Broker | NSE Member Code | Avg Daily Users | Currency Pairs | Mobile Rating |

|---|---|---|---|---|---|

| Zerodha Kite | Zerodha | 90001 | 6.2 million | 4 | 4.4 |

| Upstox Pro | Upstox | 26000 | 3.8 million | 4 | 4.3 |

| Angel One | Angel One Ltd | 15053 | 4.1 million | 4 | 4.5 |

| 5Paisa | 5Paisa Capital | 90040 | 1.9 million | 4 | 4.2 |

| FYERS | FYERS Securities | 90077 | 0.8 million | 4 | 4.6 |

| Alice Blue | Alice Blue Online | 90052 | 0.6 million | 4 | 4.1 |

Zerodha processes 18% of all currency contracts; FYERS offers free API for algo traders. Install FYERS and Alice Blue. Set ₹1 lakh virtual margin. Short 1 lot USD/INR December futures at 83.45. Cover at 83.35 after 30 minutes. Repeat 15 times. Calculate net brokerage + taxes.

Security Measures in Forex Apps

Apps deploy 256-bit AES encryption, TLS 1.3, and device binding. Funds sit in segregated client accounts with Tier-1 banks.

Login Layers

- MPIN (6-digit)

- Biometric (fingerprint/face)

- OTP to registered mobile

- Session timeout after 5 minutes idle

Fraud Detection

AI flags logins from new cities. Auto-freeze triggers on 3 wrong MPIN attempts. Enable biometric + OTP. Log in from a friend’s phone. Note instant SMS alert and account lock. Call support to unlock – time the process.

Key Features of Reliable Apps

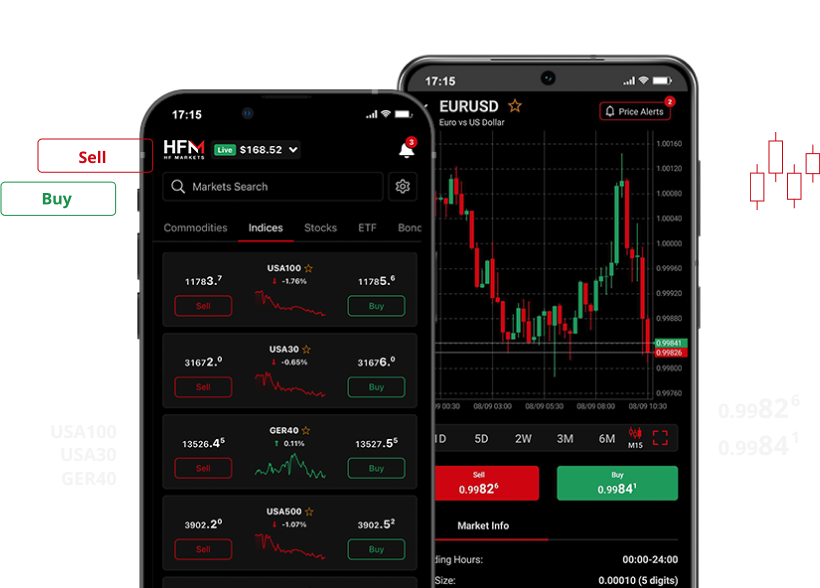

When selecting a trading app, focus on performance, stability, and essential tools that support your trading strategy. A reliable platform should offer fast order execution, clean chart visuals, and minimal downtime during peak hours. Charts should load in under two seconds on a 4G connection to ensure you don’t miss key entry points. Over 80 built-in indicators, including VWAP, Supertrend, and Open Interest, provide flexibility for technical analysis. Apps with strong data accuracy and responsive customer support make daily trading smoother and more consistent.

Order Types Available

Different order types help traders manage risk and precision. Understanding how each one works allows better control over entries and exits during market movements.

- Market Order – fills instantly at the current available price

- Limit Order – waits until your chosen price level is reached

- Stop Order – activates once the market hits a preset trigger level

- Bracket Order – includes automatic stop-loss and take-profit levels

Knowing how to use these orders helps minimize slippage and improve trade timing. Reliable apps provide quick order modification and cancellation options to adjust to changing market conditions instantly. Always confirm that your platform executes these orders without delay, especially during volatile sessions.

Margin Calculator

Input lot size → app shows required margin and leverage used. USD/INR 1 lot needs ₹1,500–₹1,800.

Open 5Paisa app. Use margin calculator for 10 lots EUR/INR. Screenshot result. Cross-check with NSE margin file.

How to Pick the Right App

Choosing the correct trading app depends on how often and how actively you trade. Match the platform to your trading frequency for best results. Day traders should focus on execution speed under 50 milliseconds and reliable real-time data. Weekly or positional traders, such as option sellers, benefit more from low brokerage costs and stable margin policies. Always check mobile stability, fund transfer speed, and order accuracy before committing to any app.

| Factor | Weight | Zerodha | Upstox | Angel |

|---|---|---|---|---|

| Brokerage | 30% | 9 | 9 | 8 |

| Chart Speed | 25% | 8 | 9 | 7 |

| Support Hours | 20% | 7 | 8 | 9 |

| Education | 15% | 6 | 7 | 9 |

| API Access | 10% | 8 | 6 | 5 |

| Total Score | 7.8 | 8.1 | 7.9 |

This comparison helps identify which platform fits your trading style and technical needs. Build your own decision matrix in Google Sheets to customize according to personal priorities. Add at least two more apps you are interested in testing. Rank them after 20 demo trades to evaluate real execution speed, chart stability, and order accuracy before funding your live account.

Common Risks and Avoidance

Trading in Forex involves real financial risks, especially when news or global data releases move markets suddenly. Over-leverage can wipe out accounts within minutes during major events like RBI policy updates or international interest rate decisions.

Unregulated brokers and offshore apps increase risk even further. Many traders fall into traps by trading high-margin products or contracts outside India’s regulatory reach. These activities not only lead to potential losses but can also attract penalties from authorities. Always check if your broker is registered with SEBI and if the product is listed on NSE or BSE before placing trades.

- 2023: A Mumbai trader was fined ₹42 lakh for trading offshore CFDs illegally.

- 2024: A Chennai user lost ₹18 lakh using an unregulated mobile app with no possibility of fund recovery.

These incidents show how lack of regulation and poor risk management can result in both financial and legal trouble. Always test your strategy in a demo account first to measure performance under real market conditions. Trade 50 lots on a demo with 1:20 leverage and cap your daily loss at ₹500 virtual money. Stop trading after three consecutive losing days and analyze what went wrong before continuing. This approach builds discipline, prevents emotional decisions, and helps protect your capital from unnecessary losses.

Tips for Safe App Usage

Update apps every Tuesday – most patches drop then. Trade only 9:00 AM–5:00 PM IST to avoid overnight gaps.

Emergency Steps

- Lost phone → login via web → freeze account

- Suspicious SMS → forward to broker fraud team

- Tax filing → download contract notes monthly

Tax Rules Quick View

Understanding how taxes apply to your Forex and stock trades is essential for accurate profit tracking and compliance. Different holding periods attract different tax rates, and charges such as the Securities Transaction Tax (STT) also affect the final return. Keeping clear records of your trades helps avoid mistakes when filing taxes and ensures transparency with financial authorities.

| Holding | STT | Tax Rate |

|---|---|---|

| < 1 day | 0.025% buy | 15% STCG |

| > 1 day | 0.025% buy | 10% LTCG >₹1L |

After each trading month, export your contract notes from Groww or your trading platform and review all transactions. Calculate the total STT paid and compare it with the broker’s tax summary for accuracy. Keeping organized records helps during audits or annual return filing and makes it easier to track overall trading performance across multiple platforms.

FAQ

Which law governs forex apps in India?

FEMA 1999, SEBI Regulations 2000, RBI Master Direction on LRS.