Cryptocurrency trading in India has grown quickly, with millions of users investing in Bitcoin, Ethereum, and other digital coins. Choosing the right trading platform is very important for beginners and professionals. A good platform should offer security, simple navigation, quick transactions, and strong customer support. Many users lose money not because of bad trades, but because they pick unsafe or unregulated exchanges.

Indian traders look for platforms that support UPI deposits, fast withdrawals, and clear trading fees. For example, using apps like WazirX, CoinDCX, or Binance allows easy crypto buying with INR. These platforms also provide charts, price alerts, and learning tools for beginners. Selecting a verified and safe crypto exchange ensures smooth trading and protects digital assets from fraud or theft.

Key Points to Consider Before Choosing a Crypto Platform

Before opening a crypto trading account, it’s essential to evaluate each platform carefully. The right exchange should balance safety, user convenience, and transparent pricing. Since cryptocurrency markets operate without central regulation, traders must choose platforms that adhere to Indian laws and use secure systems for transactions. Comparing key features before signing up ensures that your funds and data remain protected while providing a smooth trading experience.

Security and Regulation

Security should always be your top priority when selecting a crypto exchange. Choose platforms that enforce full KYC (Know Your Customer) verification and two-factor authentication (2FA) to prevent unauthorized access. Regulated or compliant exchanges also maintain transparent fund-handling policies and regularly conduct third-party security audits. In India, reliable platforms such as CoinDCX, ZebPay, and WazirX follow RBI and SEBI monitoring standards through registered entities. Avoid using foreign or unlicensed apps that do not require KYC — these often pose high risks of scams or frozen withdrawals.

User Experience

A clean and simple interface makes trading smoother, especially for beginners. The platform should offer easy navigation, fast order execution, and customizable charts. Look for features like price alerts, portfolio tracking, and instant deposits to simplify trading. For new users, educational support — such as tutorials and FAQs — is also an important part of a good user experience. Exchanges like CoinDCX and WazirX are particularly known for their user-friendly dashboards, which allow both beginners and experienced traders to operate efficiently.

Most Popular Crypto Trading Platforms in India

India has seen strong growth in domestic crypto exchanges offering secure, INR-supported services. Each platform has unique features suited for different trader types — from beginners to professionals.

WazirX

Founded in India, WazirX is one of the country’s most widely used exchanges. It supports INR deposits via UPI and bank transfer and offers hundreds of cryptocurrencies for trading. The platform also allows peer-to-peer (P2P) transactions, enabling users to buy and sell crypto directly without intermediaries. WazirX has a transparent fee system, and its integration with Binance makes it attractive for those wanting access to global markets.

CoinDCX

CoinDCX is a SEBI-registered exchange that provides fast verification, an intuitive interface, and educational tools through CoinDCX Learn. It’s known for its low trading fees, smooth mobile experience, and responsive customer support. The platform also offers margin and futures trading for advanced users. CoinDCX focuses on simplifying crypto for Indian users while maintaining strong compliance with local financial laws.

ZebPay

One of the oldest crypto exchanges in India, ZebPay has built a reputation for reliability and strong security. It offers a clean interface, wallet services, and even fixed deposit-like earning features where users can earn interest on held coins. With its focus on safety and transparent transactions, ZebPay is ideal for users who prioritize long-term holding and secure storage.

Binance

Binance is a global crypto exchange that allows Indian users to trade via P2P systems in INR. It provides advanced trading features such as futures, staking, and spot markets. Binance supports professional traders with detailed charting, AI-based analysis tools, and automated trading options. Although it’s an international exchange, its P2P platform ensures Indian users can fund and withdraw money conveniently through local payment methods.

Comparing Trading Fees and Charges

Trading fees vary across exchanges and can affect your overall profit margins. Beginners often overlook these costs, but understanding them helps in long-term savings. Fees are usually charged as a percentage of each trade or as small transaction costs for deposits and withdrawals.

| Platform | Trading Fee | Deposit | Withdrawal |

|---|---|---|---|

| WazirX | 0.2% | Free (UPI) | ₹10–₹30 |

| CoinDCX | 0.1% | Free | ₹10–₹50 |

| ZebPay | 0.15% | Free | ₹15 |

| Binance | 0.1% | Free | Based on method |

Smart traders use limit orders instead of market orders to save on trading costs, as limit orders often incur lower fees. Some platforms also offer referral bonuses, cashback programs, or discounts on trading fees when using their native tokens (like WazirX’s WRX or Binance’s BNB). Additionally, consolidating trades instead of making frequent small transactions can reduce cumulative charges. Regularly check each exchange’s fee updates, as platforms occasionally change pricing based on trading volume or network congestion.

Payment Options and INR Support

Smooth deposit and withdrawal options are crucial for crypto traders in India. Local exchanges now offer faster and safer methods to add or withdraw Indian Rupees (INR), making it easier to buy or sell digital assets without delays. The goal is to ensure convenience while maintaining full compliance with banking and tax regulations. A platform that supports multiple INR payment methods helps users avoid transaction issues and keeps trading uninterrupted.

Deposit and Withdrawal Methods

Most Indian exchanges, including CoinDCX, WazirX, and CoinSwitch Kuber, support UPI, IMPS, NEFT, and direct bank transfers for INR deposits and withdrawals. These methods allow users to fund their accounts quickly and securely using their verified Indian bank accounts. For withdrawals, funds are usually credited to the same linked account to ensure transparency and compliance with RBI monitoring. Avoid using unverified payment channels or third-party transfers, as they can lead to account freezes or failed transactions.

Fast Transaction Practice

UPI transfers are the quickest, typically completing within 10–60 seconds, making them ideal for traders who want to react to price changes immediately. IMPS and bank transfers may take up to a few hours, depending on the bank’s processing time. Some platforms even support instant settlements during working hours. Always double-check your registered bank details and ensure your KYC is fully verified before making any large transactions to avoid delays or reversals.

Mobile Apps and Accessibility

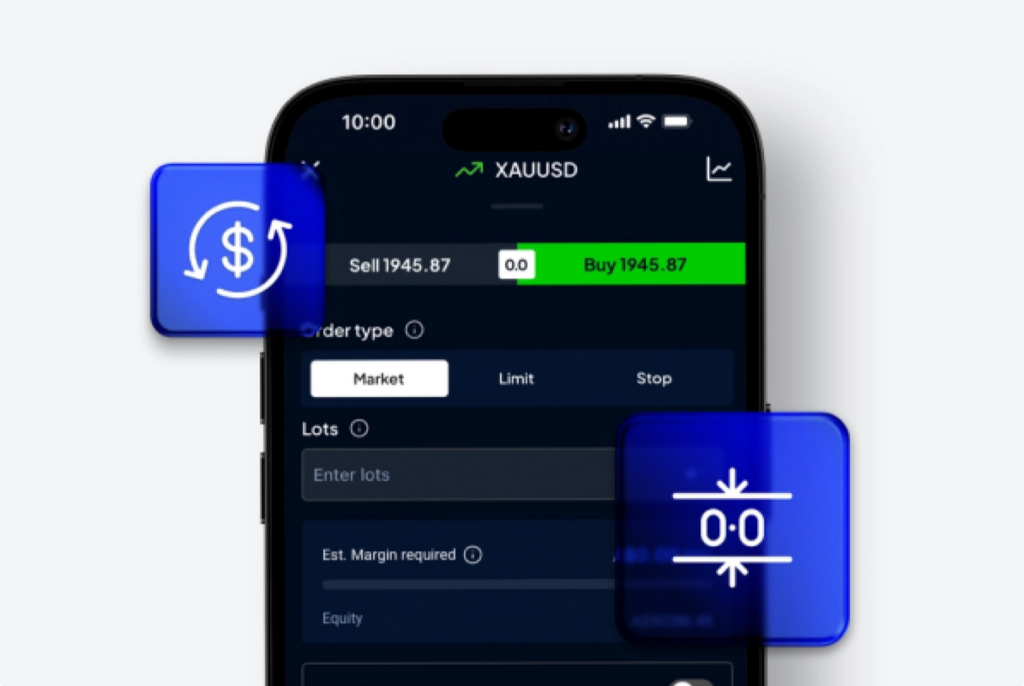

Trading on the go has become a necessity for modern crypto traders. Mobile apps allow users to track price changes, manage portfolios, and execute trades instantly from anywhere. A well-optimized app ensures that traders never miss an opportunity, even during high market volatility.

Leading exchanges such as CoinDCX, WazirX, and Binance India offer user-friendly mobile applications with seamless performance on both Android and iOS. These apps include advanced charting tools, live notifications, and instant order execution. Many also provide biometric login and in-app customer support for quick assistance. A stable app with fast response times is especially valuable for traders who make multiple entries or exits within short timeframes.

Mobile access keeps traders connected to the market at all times. It enables quick reactions to sudden price spikes or dips — a crucial advantage in a 24/7 market like crypto. Traders can monitor portfolios, view charts, and execute stop-loss or take-profit orders within seconds. Reliable mobile access also increases safety, as users can quickly transfer funds or lock accounts in case of suspicious activity.

Security Features to Protect Your Crypto

Security is the most important factor in cryptocurrency trading. Since crypto assets operate in a decentralized environment, traders must rely on their own safety practices along with platform-level protections. The best exchanges prioritize user security through advanced technology and regular audits.

- Two-Factor Authentication (2FA) – Adds an extra security layer requiring OTP verification before login or withdrawal.

- Cold Wallet Storage – Keeps most funds offline, protecting them from hacking attempts.

- Regular Security Audits – Ensures systems are updated and free from vulnerabilities.

- Withdrawal Whitelisting – Allows withdrawals only to pre-approved wallet addresses.

These features make trading platforms safer and reduce the chance of cyber theft or unauthorized access. No matter how secure a platform is, personal responsibility is key. Traders should avoid keeping large crypto amounts on exchanges for long periods. Instead, move long-term holdings to private or hardware wallets like Ledger or Trezor. Always keep recovery phrases offline and avoid sharing login details or OTPs. Use strong passwords and change them regularly. Staying cautious ensures your digital assets remain protected, even if the platform faces temporary technical or security issues.

Learning and Support Options

Crypto trading requires not just capital but also strong knowledge and continuous learning. Since the market operates 24/7 and prices change rapidly, traders must understand the basics of blockchain, order types, and risk control. Reputable exchanges make this easier by offering built-in education and support resources that help users grow their skills safely.

Educational Resources

Many top exchanges, including CoinDCX and Binance, provide dedicated learning sections that cover everything from crypto fundamentals to advanced price analysis. These sections include video tutorials, quizzes, and guides explaining how wallets, trading pairs, and market indicators work. Some platforms also host webinars and community forums where traders can ask questions directly to experts. Taking time to learn these basics helps beginners avoid scams, understand token values, and make smarter trading decisions. Education is especially vital in crypto because the market reacts quickly to global events, making informed analysis your best tool for survival.

Customer Support

Responsive customer support is essential for a positive trading experience, especially when dealing with deposits, withdrawals, or verification issues. Choose exchanges that offer 24/7 support through live chat, email, or social channels. Quick assistance can prevent costly delays during volatile market conditions. Before choosing a platform, check user reviews about support response times and issue resolution rates. Well-managed exchanges often provide detailed FAQs, help centers, and even chatbots for instant problem-solving. Reliable customer service ensures smoother trading and greater peace of mind for both beginners and professionals.

Future of Crypto Trading in India

The future of cryptocurrency trading in India is promising but still developing. Government authorities are actively working on building a structured framework for crypto regulation. Once laws are finalized, trading is expected to become safer, more transparent, and widely accessible.

Regulation and Growth

The Indian government, along with regulatory bodies like SEBI and RBI, continues to discuss taxation, licensing, and compliance for digital assets. Over time, new rules will likely bring clarity and legal protection to crypto investors. As the framework evolves, more registered exchanges with robust KYC procedures and transparent operations are expected to emerge. This shift will enhance investor confidence and reduce the risks of fraud or misuse. Legal clarity will also attract institutional investors, creating more liquidity and job opportunities in the crypto space.

Expanding Opportunities

Crypto adoption in India is growing at a fast pace, with thousands of new users joining exchanges each month. Platforms like WazirX, CoinSwitch Kuber, and CoinDCX are making digital asset trading simpler for Indian users by offering INR deposits and multilingual apps. The key for new traders is learning risk management — such as setting stop-losses and avoiding emotional trades — while keeping funds in verified wallets. As the market matures, India could become one of the largest crypto trading hubs in Asia.

Tips for Beginners in Crypto Trading

Entering the crypto market can be exciting but also risky. Beginners should approach it strategically, focusing on safety and gradual learning. Building experience through small steps helps minimize mistakes while improving trading skills over time.

- Start with small investments — never invest money you can’t afford to lose.

- Verify your account and enable 2FA (Two-Factor Authentication) for added security.

- Use stop-loss orders on highly volatile coins to control potential losses.

- Stay updated with market news and blockchain developments from reliable sources.

Following these steps creates a strong foundation for safe trading and helps you avoid common beginner pitfalls like overtrading or falling for pump-and-dump schemes.

Building Confidence

Before trading with large amounts, practice using demo features or paper trading tools available on some exchanges. These simulate real market conditions without using real money, allowing you to test your strategies risk-free. Once you’re comfortable reading charts, managing trades, and reacting to volatility, gradually move to live trading with small capital. Consistent practice builds confidence, improves decision-making, and prepares you for real market challenges.

FAQ

Which crypto trading platform is best for beginners in India?

WazirX and CoinDCX are beginner-friendly with INR deposits and low fees.