Good providers track wins openly, often over 70% accurate on verified accounts. They suit beginners learning setups and pros testing ideas. Costs range from free daily tips to $50 monthly for full access. Always pair signals with your plan—blind follows lead to losses. Test on demos to see fit before live trades.

What Are Forex Signals?

Forex signals are alerts with trade details: pair, direction (buy/sell), entry price, stop loss, and take profit. Experts base them on technical tools like moving averages or RSI, plus economic data like rate decisions. A signal might say “Buy AUD/USD at 0.6750, stop 0.6720, target 0.6800” for 50 pips potential. Providers send 3-5 daily, focusing on majors for steady action. Use them to spot chances you miss, but adjust for your risk—aim 1% account per trade. Verified records on sites like Myfxbook show real performance, not just claims.

Top Forex Signal Providers in 2025

These stand out for 75%+ win rates, quick delivery, and user feedback from Trustpilot and forums. They mix free trials with paid tiers, covering forex plus gold or indices. Each offers Telegram for instant pushes, with education to build skills. Pick based on your style: scalpers want frequent tips, swing traders need longer holds.

5paisa

For traders looking to start investing with low costs, 5paisa stands out as one of India’s most affordable online brokers. It’s designed for self-directed investors who want full market access without paying high commissions.

- Rating: 4.2 / 5.0

- Trading Type: Low-cost trades

- Markets: Stocks, Derivatives, Mutual Funds

- Minimum Deposit: ₹0

- Leverage: Up to 1:20

- Platforms: Web, Mobile Apps

5paisa is a budget-friendly broker offering flat-fee trading with no hidden costs. It’s ideal for traders looking to cut expenses while accessing a powerful mobile and web platform. The app supports direct stock and derivatives trading with smooth order placement.

Mirae Asset (Sharekhan)

Mirae Asset, in partnership with Sharekhan, provides one of the most trusted trading ecosystems in India. It’s best for investors who want low fees, access to expert research, and a mix of equity and fund-based investment options.

- Rating: 4.6 / 5.0

- Trading Type: Low brokerage fees

- Markets: Stocks, Mutual Funds, ETFs

- Minimum Deposit: ₹100

- Leverage: Up to 1:20

- Platforms: Web, Mobile Apps

Mirae Asset, partnered with Sharekhan, provides a reliable trading experience with low commissions and research-backed insights. It supports stock, mutual fund, and ETF investments. A good choice for investors wanting professional tools at a reasonable cost.

IIFL Securities

IIFL Securities is suited for traders who want more than just a trading app. It combines advisory, in-depth research, and portfolio management, making it ideal for serious investors focused on long-term growth.

- Rating: 4.3 / 5.0

- Trading Type: Full-service broker (higher brokerage)

- Markets: Stocks, Derivatives, Mutual Funds, IPOs

- Minimum Deposit: ₹500

- Leverage: Up to 1:15

- Platforms: Web, Mobile Apps

IIFL Securities is known for its research-based recommendations and a strong mobile app. Although its fees are slightly higher, it delivers top-tier analysis, advisory, and IPO access — perfect for traders who prefer a complete investment ecosystem.

Shoonya (Finvasia)

Shoonya by Finvasia is one of the most transparent and cost-effective brokers available today. With zero brokerage across all products, it’s perfect for traders who want to keep more of their profits.

- Rating: 4.7 / 5.0

- Trading Type: Zero-commission trades

- Markets: Stocks, Derivatives, Commodities

- Minimum Deposit: ₹0

- Leverage: Up to 1:20

- Platforms: Web, Mobile Apps

Shoonya by Finvasia offers true zero-brokerage trading — no fees on any asset class. It’s one of the most transparent platforms in India, with modern charts, low latency, and high leverage options. Excellent for day traders and active investors.

Samco

Samco is a smart choice for traders who want the right balance between affordability and functionality. It offers strong analytics tools and user-friendly design, making it ideal for those managing multiple trades daily.

- Rating: 4.4 / 5.0

- Trading Type: Low brokerage

- Markets: Stocks, Derivatives, Mutual Funds

- Minimum Deposit: ₹0

- Leverage: Up to 1:20

- Platforms: Web, Mobile Apps

Samco combines low brokerage rates with access to multiple markets. The platform includes advanced analytics, a user-friendly dashboard, and tools for portfolio management. Best for cost-conscious traders who want high leverage and good customer service.

Alice Blue

Alice Blue appeals to traders who value simplicity and cost savings. With zero delivery charges and a responsive trading platform, it’s one of the most affordable brokers in India.

- Rating: 4.3 / 5.0

- Trading Type: Zero delivery charges

- Markets: Stocks, Derivatives, Commodities

- Minimum Deposit: ₹0

- Leverage: Up to 1:20

- Platforms: Web, Mobile Apps

Alice Blue offers one of the cheapest trading options with zero delivery charges and strong support for F&O and commodities. The platform provides smooth mobile access and integration with third-party charting tools, perfect for regular traders.

Anand Rathi

Anand Rathi is designed for investors who prefer personalized service and expert advice. It’s a long-established brokerage with a full range of financial products and relationship-driven client support.

- Rating: 4.1 / 5.0

- Trading Type: Full-service broker

- Markets: Stocks, Mutual Funds, Bonds, Commodities

- Minimum Deposit: ₹500

- Leverage: Up to 1:10

- Platforms: Web, Mobile Apps

Anand Rathi is a long-standing full-service brokerage offering personalized advisory and portfolio management. It suits investors seeking relationship-based services and customized financial planning, along with access to equity, mutual funds, and wealth products.

How to Pick a Forex Signal Provider

Choosing a reliable forex signal provider can enhance your trading success, but it requires careful checks to weed out scams that cost losing traders $500 million in 2025, based on industry accounts. Start with confirming win rates on websites like Myfxbook, seeking providers with at least 70% success over six months, and re-verifying user feedback on Trustpilot for honest opinions on support or late execution. Test signals on free trials in demo accounts to ensure they correspond to your trading time, especially for volatile pairs like EUR/USD. Ensure win rates: Verify Myfxbook for 70%+ success in 6+ months.

- User reviews: Support quality and payout issues are revealed by Trustpilot.

- Demo test: Free trials ensure signal timing is appropriate for your schedule.

- Ask for signal logic: Plain language explanations (e.g., MACD cross) overperform blind targets.

- Compare costs: $30-$50/month plans generally outperform free signals.

- Send first: Messages on Telegram arrive 10 times faster than email.

Providers like FXStreet with 72% win rates on majors Q3 2025 save time for traders by automatically performing entries based on user logs. Always start with a $100 demo to test signal precision and risk set to 1% per trade to maintain losses. As of October 27, 2025, scams had increased 15% after regulatory reforms, so check provider credentials and reject offers promising 90%+ wins with no proof.

Risks in Following Forex Signals

Signals miss marks 20-30% of the time, turning small stops into account hits if oversized. Delays from poor internet eat edges in fast markets. Over-reliance skips learning, leaving you lost in quiet spells. Scams hype 90% wins without proof—spot via unverified claims. Market shifts like recessions flip strategies. Always cap risk at 1% and review weekly to tweak.

Ways to Use Forex Signals Effectively

Forward-test signals on paper trades for two weeks to gauge fit. Scale sizes based on volatility—tight stops for news days. Combine with your indicators, like adding MACD confirmation. Log every outcome: wins, losses, pips. Ignore off-hours alerts if asleep. Rotate providers quarterly for fresh views. Pair with calendars to skip high-risk events.

Free vs Paid Forex Signal Services

Free options like FXLeaders basic give 1-2 daily tips but lack depth or support. Paid like 1000pip Builder add analysis and 80%+ rates, worth $50 if you trade $5k+. Frees build habits; paids scale profits. Watch for hidden upsells in free groups. In 2025, hybrids offer free trials leading to paid—use to compare without commitment.

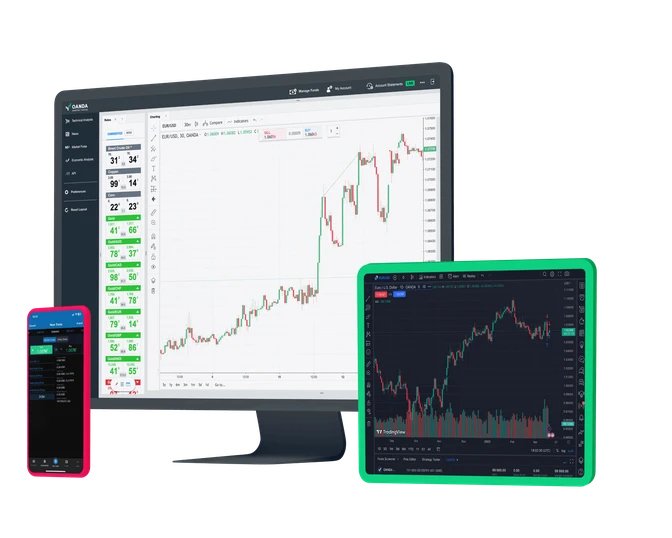

Broker Compatibility for Signal Trading

Top brokers like IG or FOREX.com link directly to signals via MT4, cutting manual entry errors. Check latency—ECN types execute under 50ms for scalps. Low spreads under 0.5 pips on EUR/USD save on frequent trades. VPS options keep bots running 24/7. Regulated ones protect funds if provider fails. Test broker demos with sample signals first.

FAQ

What win rate should I expect from forex signals?

70-85% on verified providers like Learn2Trade. Higher claims often hide drawdowns—check full histories.