Traders chase high leverage for more action on tight budgets, especially in quiet markets like major pairs. Yet it demands sharp stop-loss orders and position sizing. Regulated setups add safeguards like negative balance protection, where you won’t owe extra if trades wipe out. This setup suits active styles such as scalping, but test on demos first. Offshore options open doors for higher ratios, though they trade some security for flexibility.

What Is High Leverage in Forex Trading?

High leverage in forex lets traders borrow from brokers to open larger trades than their cash allows. A 1:1000 ratio means $100 controls $100,000, so small moves yield big results. Brokers set these based on rules and account types. It cuts margin needs, freeing capital for multiple trades. But volatility can trigger quick calls, closing positions early. Use it on stable pairs like EUR/USD for better odds. Always check broker terms, as leverage drops on volatile assets.

Top High-Leverage Forex Brokers in 2025

These brokers stand out for offering ratios above 1:500, low costs, and reliable platforms. They balance access with tools like quick executions and mobile apps. Each passed tests for spreads under 1 pip on majors and fast withdrawals. Focus on your style—scalpers need low latency, while swing traders want wide asset lists.

- RoboForex

- FBS

- Tickmill

- HFM (HF Markets)

- FP Markets

- XM

RoboForex

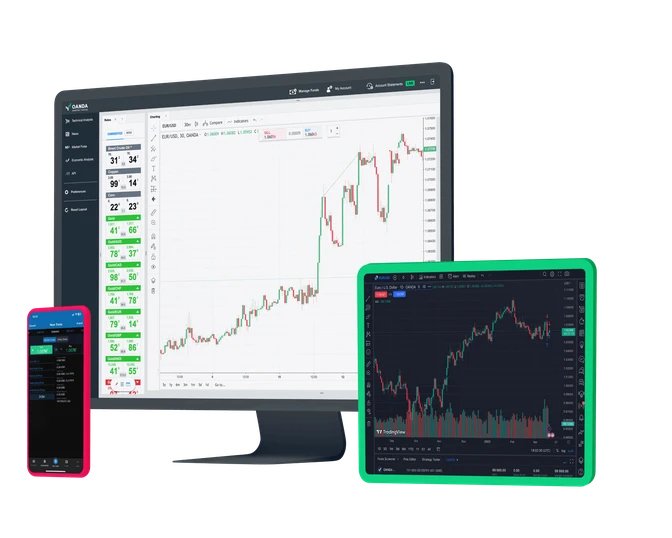

RoboForex App Overview

RoboForex delivers 1:2000 leverage across forex and CFDs, ideal for small accounts. Belize FSC oversight ensures fair play, with negative balance shields. Cent accounts let you trade micro-lots from $10. Execution speeds under 50ms suit day traders.

| Feature | Details |

|---|---|

| Max Leverage | 1:2000 |

| Min Deposit | $10 |

| Platforms | MT4, MT5, R Trader |

| Regulation | IFSC (Belize) |

| Account Types | ProCent, Pro, ECN |

| Spreads | From 0.4 pips |

| Copy Trading | R Trader platform |

| Execution Speed | Under 50ms |

Spreads average 0.4 pips on GBP/USD, keeping costs down during news events.

FBS

FBS App Overview

FBS pushes 1:3000 leverage for aggressive plays, regulated in Belize and CySEC. Minimum $5 entry draws beginners, with bonuses up to 100% on deposits. MT4/MT5 support plus a web trader make it simple. Islamic accounts skip swaps.

| Feature | Details |

|---|---|

| Max Leverage | 1:3000 |

| Min Deposit | $5 |

| Platforms | MT4, MT5, WebTrader |

| Regulation | IFSC (Belize), CySEC |

| Bonuses | Up to 100% on deposits |

| VPS Hosting | Free for active users |

| Support Languages | 27+ |

| Islamic Accounts | Available |

It excels in emerging markets, where high ratios offset thin liquidity.

Tickmill

Tickmill App Overview

Tickmill offers 1:1000 leverage under FCA and FSCA rules, focusing on raw spreads from 0.0 pips plus $4 commissions. Raw accounts fit ECN fans, with $100 minimums. Over 200 instruments cover forex to shares.

| Feature | Details |

|---|---|

| Max Leverage | 1:1000 |

| Min Deposit | $100 |

| Platforms | MT4, MT5 |

| Regulation | FCA (UK), FSCA (South Africa) |

| Instruments | 200+ (Forex, Indices, Shares) |

| PAMM Accounts | Available |

| Execution Speed | Under 100ms |

Quick setups and PAMM for managed funds add value for hands-off users.

HFM (HF Markets)

HFM App Overview

HFM provides 1:2000 leverage via offshore arms, with FCA/CySEC for mains. Zero spreads on Ultra Low accounts from $50 deposits. Elite programs refund up to 20% commissions based on volume.

| Feature | Details |

|---|---|

| Max Leverage | 1:2000 |

| Min Deposit | $50 |

| Platforms | MT4, MT5 |

| Regulation | FCA, CySEC, FSCA |

| Spreads | From 0.0 pips |

| Cashback Program | Up to 20% |

| Copy Trading | Available |

| Assets | 350+ |

Strong for copy trading, where you mirror top performers without coding.

FP Markets

FP Markets App Overview

FP Markets hits 1:500 leverage, ASIC and CySEC regulated for trust. IRESS platform adds pro tools beyond MT5. Spreads from 0.0 pips, $100 minimum. Over 10,000 CFDs span global exchanges.

| Feature | Details |

|---|---|

| Max Leverage | 1:500 |

| Min Deposit | $100 |

| Platforms | MT4, MT5, IRESS |

| Regulation | ASIC, CySEC |

| Instruments | 10,000+ CFDs |

| Spreads | From 0.0 pips |

| Trading Model | ECN / DMA |

| Python API | Supported |

It suits algo traders with integration and low latency servers.

XM

XM App Overview

XM caps at 1:1000 leverage, MiFID II compliant via CySEC. Micro accounts start at $5, with 1,000+ instruments. Free webinars and 1-on-1 coaching build skills. Spreads from 0.6 pips on standard.

| Feature | Details |

|---|---|

| Max Leverage | 1:1000 |

| Min Deposit | $5 |

| Platforms | MT4, MT5 |

| Regulation | CySEC, ASIC |

| Spreads | From 0.6 pips |

| Demo Funds | $5,000 |

| Support Languages | 16+ |

| Bonuses | Loyalty rewards available |

Great entry point, as it waives fees on first deposits under $5,000.

How to Choose a High-Leverage Forex Broker

Choosing a high-leverage broker requires balance between opportunity and safety. Always start by checking the broker’s regulation — firms licensed by FCA, ASIC, or CySEC provide better fund protection than offshore-only entities. Verify execution quality through demo accounts, and test live spreads on major pairs, aiming for under 1 pip. Review withdrawal processing times — reliable brokers handle payouts within 24 hours. Bonuses may look appealing, but read terms carefully for any wagering requirements. For beginners, a leverage ratio around 1:500 is manageable, while experienced traders may explore higher levels.

Checklist for choosing a high-leverage broker:

- Regulation by trusted authorities (FCA, ASIC, CySEC)

- Live spreads under 1 pip for major pairs

- Fast withdrawals (within 24 hours)

- Demo account for platform testing

- Transparent bonus conditions

- Adjustable leverage options

A good broker provides flexibility, but traders must choose leverage that aligns with their experience, risk tolerance, and capital preservation goals.

Risks of Trading with High Leverage

High leverage can multiply profits, but it also increases risk exposure. A 1% market move against you at 1:1000 leverage can completely erase your margin. Frequent margin calls may force early exits, locking in losses and limiting recovery options. Traders often overtrade when leverage is high, chasing missed moves and depleting accounts quickly.

Common risks to watch for:

- Rapid loss amplification during volatility

- Margin calls leading to forced liquidations

- Overtrading due to psychological pressure

- Increased sensitivity during economic events

To manage these risks, limit exposure to 1–2% per trade, use stop-loss and trailing stops, and review equity levels daily. Responsible use of leverage, combined with strong discipline, turns it into a tool — not a threat — for long-term trading success.

Tips for Safe High-Leverage Trading

Set position sizes to risk no more than 1% of capital per setup. Use tools like ATR for stop distances on pairs. Journal trades to spot patterns in losses. Backtest strategies on historical data before live runs. Diversify across 3-5 pairs to spread exposure. Pause after three losers to reset. Scale up leverage only after six months consistent profits.

Regulations for Leverage in Different Regions

Leverage limits vary by region to protect traders from excessive risk. In the European Union, the ESMA restricts retail traders to a maximum of 1:30 on major currency pairs and 1:20 for minors or exotics. Professional clients, however, can access up to 1:500, provided they meet strict eligibility criteria. The US NFA and CFTC apply tighter controls, capping leverage at 1:50 for major pairs and 1:20 for others, aiming to minimize market instability and prevent overexposure.

In Australia, the ASIC aligns with ESMA’s rules, keeping leverage at 1:30 for retail traders, while professional clients can request higher limits. In contrast, offshore jurisdictions such as Seychelles (FSA), Belize (IFSC), or St. Vincent and the Grenadines allow leverage up to 1:1000 or more, appealing to experienced traders seeking flexibility. Switching to an offshore entity is an option for qualified professionals, though it requires proof of trading experience or a financial portfolio exceeding $500,000 to meet professional trader standards.

FAQ

What is the highest leverage available in 2025?

Up to 1:3000 from brokers like FBS, but unlimited options exist at Exness for qualified accounts.